Tag: Investment Planning

Our Old Friend Volatility is Back

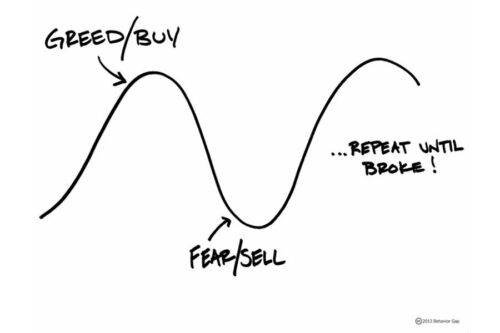

Just as many people were starting to think markets only move in one direction, the pendulum has swung the other way. Financial advisor Edward Cruickshank offers seven simple truths to help you live with volatility.

Sell in May – Go Away!

Market timing blares its horn each spring as the common adage rings, “Sell in May and Go Away!” This calls for selling your portfolio in May only to reinvest the coming October, therefore reaping potential higher risk adjusted returns. Though certain factoids support the sentiment, is it truly in your best interest? Economists continue to […]

Market Update – May 2020

May saw positive returns in the market across the majority of asset classes. U.S. small (+6.5%) led the charge domestically while international small came in strong (+7.0%) as well. Global stocks dipped slightly but still came in positive at +4.6%. Bonds hovered close to zero, with intermediate‐term bonds holding the strongest return (+0.8%). With respect […]

Why Is the Market Going up When the Economy Is Going Down?

Financial advisor Cal Brown explains why the stock market and the economy don’t always move in lockstep.

Our Guide to the Coronavirus Crisis: 6-2-2020 Coronavirus Chart Pack

Our Investment Research Team’s latest update to the Coronavirus Crisis Chart Pack: Risk assets continue to surge as continuing unemployment claims data verify that some citizens are beginning to return to work in the U.S. Download our 6-2-2020 Coronavirus Crisis Chart Pack

The Forward Looking Nature of Markets

There is one investment formula which transcends asset classes and prevails across global markets: The intrinsic value of any security is equal to the net present value of future expected cash flows. This is an ever important formula to remember, especially now when many of our lives are in a current state of disruption. Looking at […]

Our Guide to the Coronavirus Crisis: 5-12-2020 Coronavirus Chart Pack

As historically bad economic data points continue to roll in, risk assets have continued rallying as investors look to the future in updates to this week’s chart pack. Download our 5-12-2020 Coronavirus Crisis Chart Pack

What’s on Your Mind?

We answer frequently asked questions, including “Should I make changes to my portfolio in response to the coronavirus?” and “I heard that Savant is undergoing some changes, how will they impact me?” As we work together to deal with the growing impact of COVID-19, we at Team Savant are doing our part to help answer […]

Maxims for Good and Bad Markets

As we progress through this challenging economic and volatile market environment, we think it is important to illustrate that Savant’s long-standing philosophical beliefs established in 1993 still hold true today as a guide to managing investments and helping plan ideal futures for our clients. Below we have highlighted six of our 30 maxims across five […]

Market Update – April 2020

Global stocks (+11.0%) started off the second quarter on a positive note. All equity asset classes posted gains for the month with U.S. small cap stocks (+13.7%) leading the way. Fixed income asset classes were mainly positive with intermediate‐term bonds (+1.4%) and TIPS (+2.8%) being the strongest performers. Alternative asset classes were mixed on the […]

Market Update – March 2020

March experienced large swings across asset classes as markets entered the ominous beginning of the bear market. Global stocks fell (‐14.4%) as fear of the coronavirus blasted headlines. Both U.S. small value (‐26.0%) and international small value (‐19.1%) plummeted. Bonds attempted to steady markets as short‐term (+0.8%) came in positive for the month. Alternatives were […]