Are We There Yet?

Fun as it may be to tease our kids, it’s understandable why they pose the question (over and over again). They’re working with limited information. At a certain age, they lack a firm grasp of time and distance. And even if they had a map in front of them, they wouldn’t really know how to interpret it. Plus, it’s uncomfortable in the back seat of a car for an extended period.

Investors over the past 18 months have found themselves in a similar feeling of discomfort, also working with limited information and no map in hand. And as we all experience viscerally when our portfolios are in decline, time slows down. Days feel like weeks, weeks feel like months. It always feels like we’re 6 ½ hours away.

Rather than asking, “Are we there yet?”, investors have been left to ponder:

- Is inflation under control yet?

- Has the economy slowed down yet?

- Is it safe to buy bonds yet?

- Is the bear market over yet?

- Are there any bargains yet?

While we lack the Google Maps equivalent to answer any of those with great precision, we can review the data we have to at least get closer than what our gut is telling us.

Is inflation under control yet?

On the inflation front, the good news is the trend is our friend.

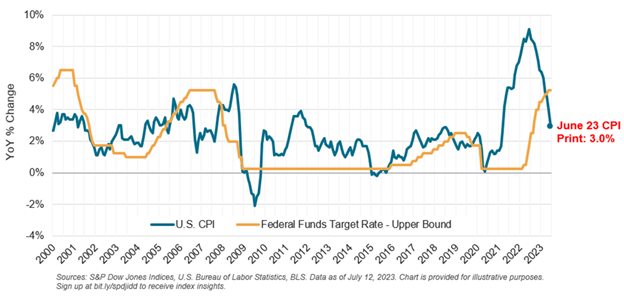

We’re not necessarily out of the woods yet, but we’ve now had 12 consecutive months of cooling year-over-year (YoY) inflation as measured by CPI. In fact, CPI came in at 3% in June, the smallest YoY increase since March of 2021. That’s six percentage points lower than the 9.1% peak we saw in June of 2022.

With CPI at 3% and the Fed Funds rate at 5%, we now have a meaningfully positive risk-free rate in real terms – something all savers and investors should embrace.

While this is all positive news, getting from 3% down to the Fed’s 2% target may prove a bit more challenging and take longer than we’d like. The Fed has taken a pause for now, but the market still expects another small rate hike (or two) in 2023.

Regardless, it does appear that we are in the final innings of this monetary policy tightening cycle.

Has the economy slowed down yet?

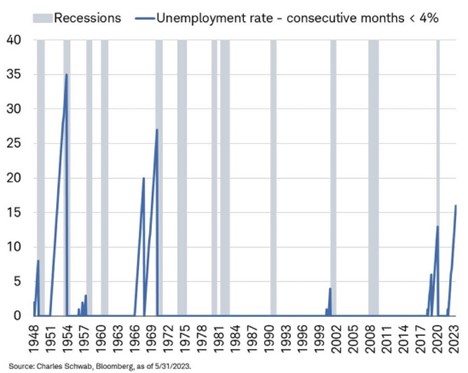

The looming recession has been “six months away” for the last 18 months. Yet the data (for the most part) continues to indicate a strong – yet slowing – economy, confounding many who expected the aggressive rate hiking cycle to break the economy and lead to a significant spike in unemployment.

It’s not all rosy by any stretch. Regional banks and commercial real estate are pockets of concern. The Conference Board Leading Economic Index® (LEI) recently saw its 14th month of decline.

And yet, the U.S. unemployment rate is at 3.6%, close to 50-year lows. Unemployment has been sub-4% now for the longest streak going back to 1970, according to Charles Schwab’s Liz Ann Sonders.

Is it safe to buy bonds yet?

Cash has been king for a while now, and many investors have been spooked out of bonds after the unpleasant experience of 2022.

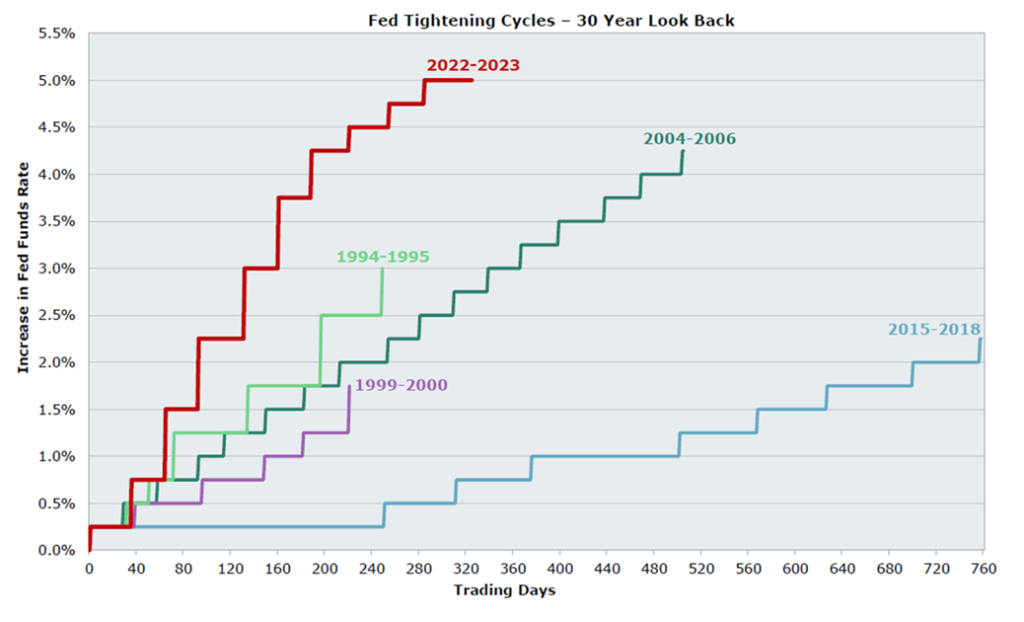

After 10 rate hikes, the Fed has now paused on its most aggressive tightening cycle in modern history.

Source: Baird. Data as of 6/30/2023.

But with an end in sight, now may be an opportune time to think about bonds, not just for their higher yields, but also for their total-return potential should we enter a period of rate cuts in the coming years.

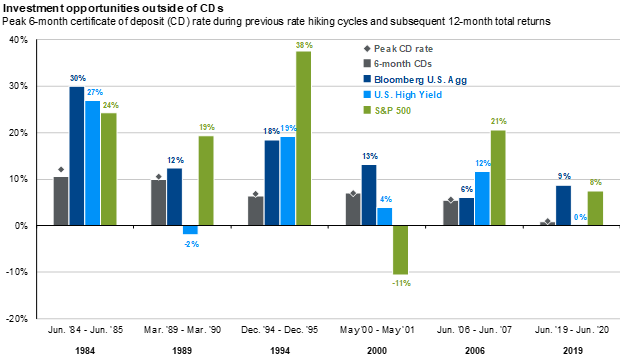

The chart below from J.P. Morgan examined the performance of six-month CDs, core bonds (Bloomberg U.S. Aggregate Bond Index, high yield bonds (Bloomberg U.S. Corporate High Yield Index), and U.S. stocks (S&P 500) after we reached peak six-month CD rates during prior rate hiking cycles. What we see is that core bonds have consistently outperformed short-term instruments like CDs in each of those historical environments.

Source: J.P. Morgan

Is the bear market over yet?

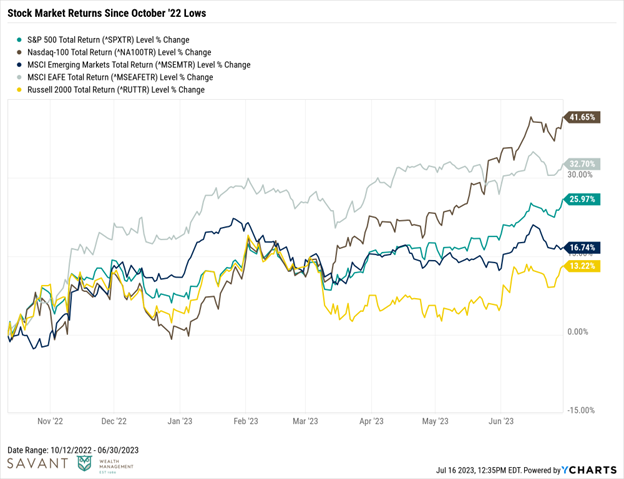

Most broad market indices are up double-digits from the October 2022 lows. While none have yet to recapture their prior all-time highs, several market bellwethers are up well in excess of 20% off the lows – the threshold we arbitrarily use to define a bull market.

Which leaves us a bit in purgatory – entering a new bull while not having fully exited the bear market. Many market participants are of the belief that it isn’t officially a new bull market until prior all-time highs are eclipsed.

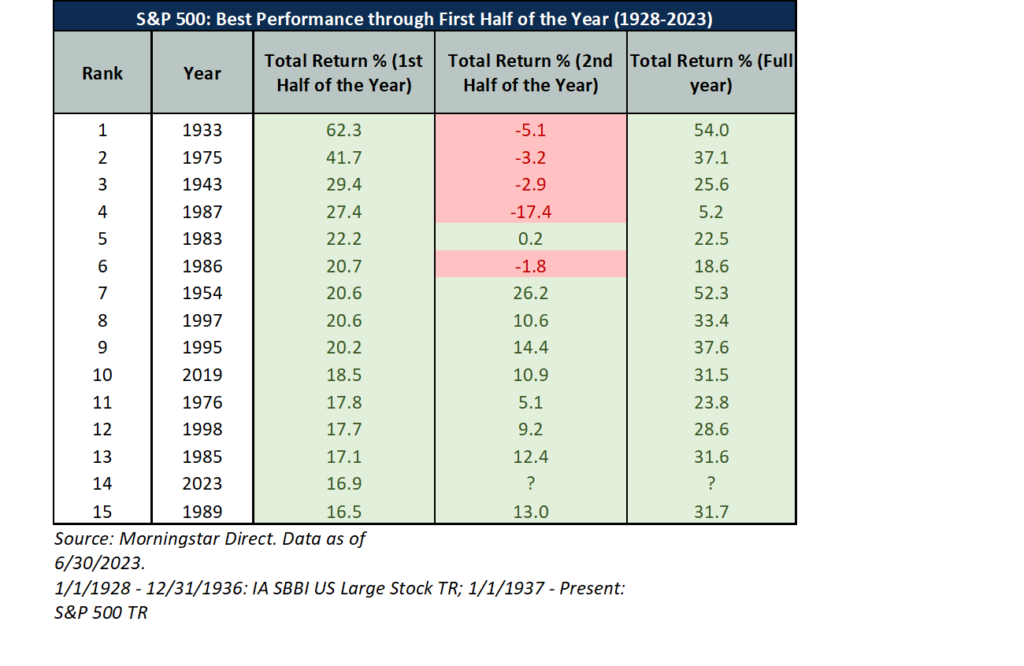

The good news is that a strong first half of the year is usually indicative of a solid second half and an expectation of positive performance for the full calendar year. Per Bespoke Investment Group, 2023 is the 23rd year since 1945 that the S&P 500 rallied more than 10% in the first half of the year. In prior years with double-digit percentage gains in the first half, the median second half performance was a gain of 10.0%, with gains 82% of the time.

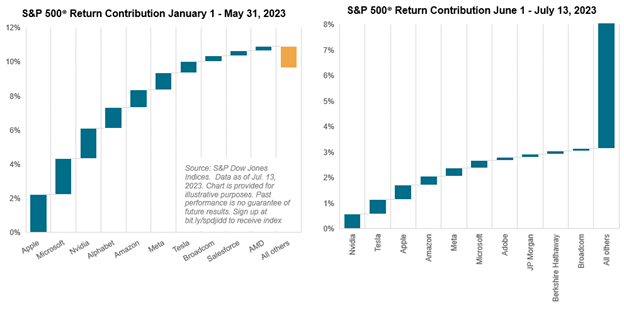

A common rebuttal to the “new bull market” narrative is that the market has been lifted this year by only a handful of stocks – specifically, what are now being referred to as the Magnificent Seven – Apple, Alphabet, Amazon, Microsoft, Meta, Tesla, and NVIDIA. And while those stocks (and a few others) have accounted for all the market gains through May of this year, this rally has broadened significantly from the beginning of June until now.

Source: S&P Dow Jones Indices

Are there any bargains yet?

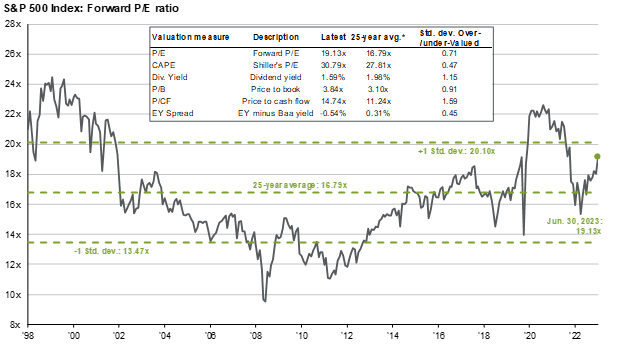

With such sharp moves up in such a short period of time, some may be left wondering if they missed the boat or if stocks are just too expensive now. Looking at the S&P 500 below across a variety of different valuation metrics, you see a consistent picture. Across all measures, the market is trading more expensive than the 25-year average.

Source: J.P. Morgan

Fortunately for investors, a much broader opportunity set exists. We don’t need to limit ourselves to the largest companies in one stock market. More attractive entry points and reasonable valuations reside in small/mid-cap stocks and in international equities.

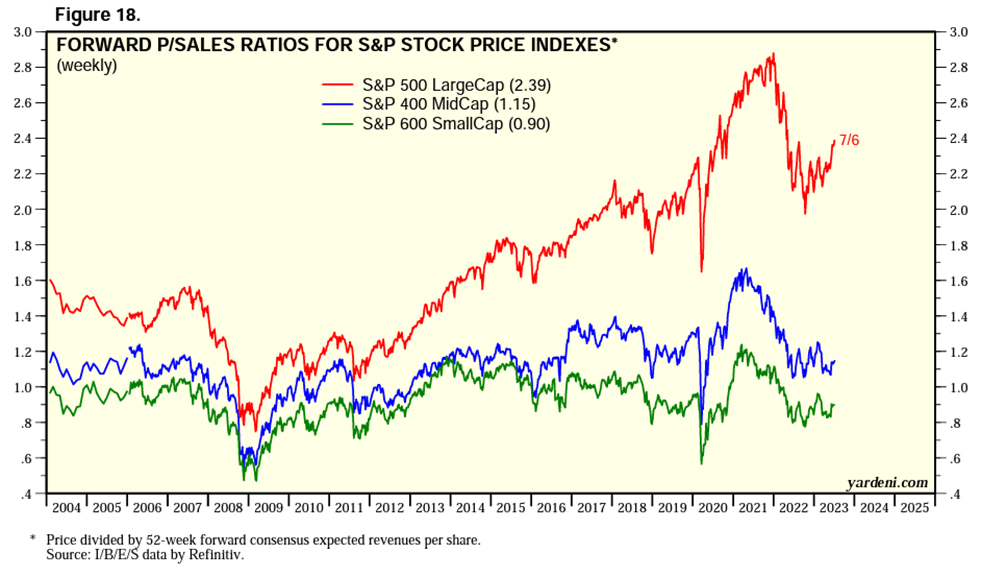

On a price-to-sales basis, we see a widening gap between larger and smaller companies, via Yardeni Research.

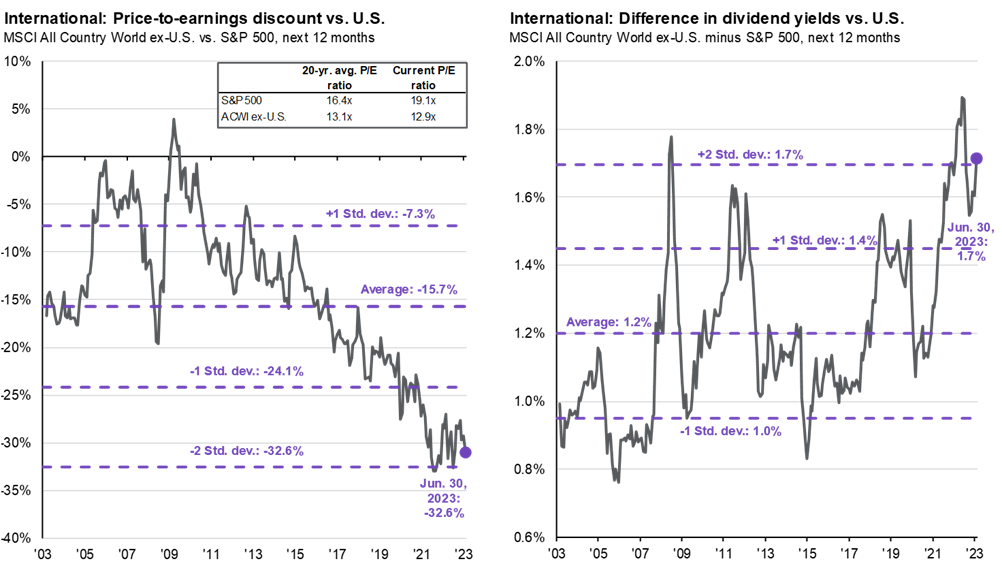

Using the MSCI All Country World ex-U.S. index as a proxy for international stocks, we see a notable discount and dividend advantage relative to their U.S. counterparts.

Source: FactSet, MSCI, Standard & Poor’s, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of June 30, 2023.

So…are we there yet?

From an economic standpoint, nothing is signaling imminent recession ahead, but growth is indeed decelerating. However, the “soft landing” scenario that many thought would be impossible has become increasingly probable.

Through the lens of markets and asset allocation, a new bull market in stocks appears to be taking shape. And while cash has been king for some time now, the risk-reward tradeoff in bonds has seemingly flipped from negative to positive. That said, we continue to believe in “diversifying your diversifiers” with various alternative investments as complements to traditional fixed income.

The hardest day to invest is always today, and while there are certainly pockets of exuberance and high prices, a world of opportunity is out there beyond the Magnificent Seven.

Your mileage may vary depending upon your risk tolerance and time horizon, but it’s beginning to feel like we’re much closer than 6 ½ hours away from better times ahead.

This is intended for informational purposes only and should not be construed as personalized investment advice. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.