2023 Presents: The Magnificent Seven, An Introduction to Top Heavy Markets

As investors look back on 2023, they will likely remember it as a positive year for stocks, with the S&P 500 finishing in positive territory. While this isn’t unusual (stocks have had more positive years than negative), the composition of return may be surprising to some.

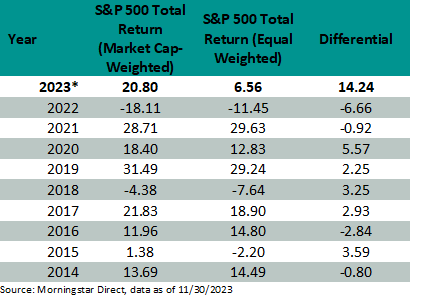

The S&P 500 is up 20.8% assuming reinvestment of dividends (as of 11/30/2023), a strong year provided markets stay level in December. As a reminder, the S&P 500 is a market cap-weighted index, meaning that the largest companies in the index make up a greater weight. To begin analyzing where returns are coming from, let’s compare the market cap-weighted index to one where all companies receive an equal weight.

Looking at the table below, we can see that over the past 10 years, market cap-weighted returns are usually close to their equal-weight counterpart, usually deviating by 2-3% in either direction. 2023 has been an outlier, with the market cap-weighted index outperforming by about 14%.

Investors may wonder, “What is causing this?”

Introducing The Magnificent Seven

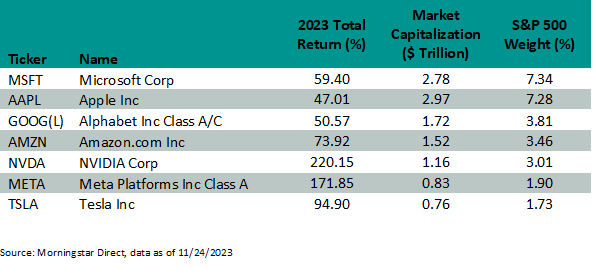

No reference to John Sturges’ 1960 western starring Steve McQueen intended, the magnificent seven in this case refers to seven leading stocks that have driven much of the S&P 500’s return in 2023.

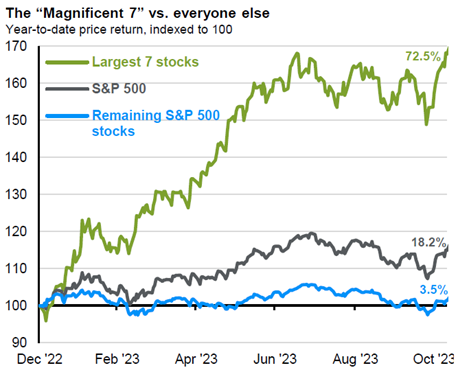

The returns above are no doubt impressive. The stellar performance of these companies paired with their high starting weights in the index have pulled the S&P 500 higher while the remaining 493 stocks provided investors with modest low single-digit returns.

Source: JP Morgan Weekly Market Recap 11/27/2023

Many of the names here have been supported by the artificial intelligence wave, as all seven of these companies (at least in part) stand to benefit from advancements in AI which has gained tremendous investor attention this year.

Will the potential advancements in AI only benefit these companies going forward? Don’t bet on it; however, the market has garnered most of its attention around these names in 2023.

What Got You Here May Not Get You There

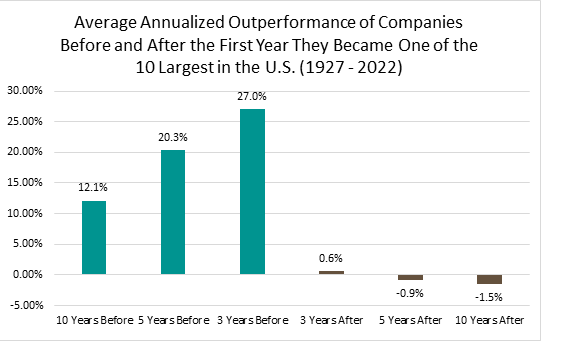

A stock must experience a spectacular stretch of returns to become one of the largest companies in the index. There is no way of getting around the math.

However, not long after joining the top 10 largest by market cap, leading stocks, on average, have underperformed the market.

Source: Dimensional Fund Advisors, reference index: Fama/French Total US Market Research Index

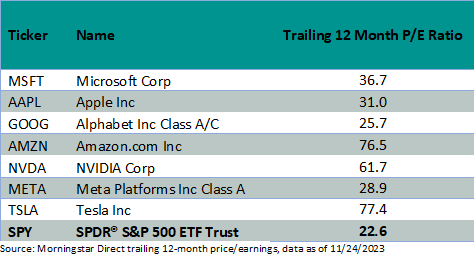

While most would like to have owned market leaders on their way to the top, investors should exercise caution when considering chasing the largest companies in the index. Companies at the top tend to trade at rich valuation multiples (a potential headwind to outperformance). Today’s market conditions are no exception.

Where Do We Go from Here?

Let’s recap where 2023 has led us so far:

- The S&P 500’s performance in 2023 has been defined by the performance of a handful of mega-cap companies.

- This structural source of returns has led the S&P 500 to become increasingly top heavy, with about 33% in the top 10 companies (as of 11/30/2023).

- History tells us that companies have potential to underperform the broad market in the years following their climb to the top.

- The top U.S. companies are trading at rich valuations (a potential headwind to continued long-term outperformance).

The good news is that investors have many options outside the S&P 500! Globally diversified investors can help significantly mitigate their concentration to the top companies in the U.S. by simply accessing other parts of the market.

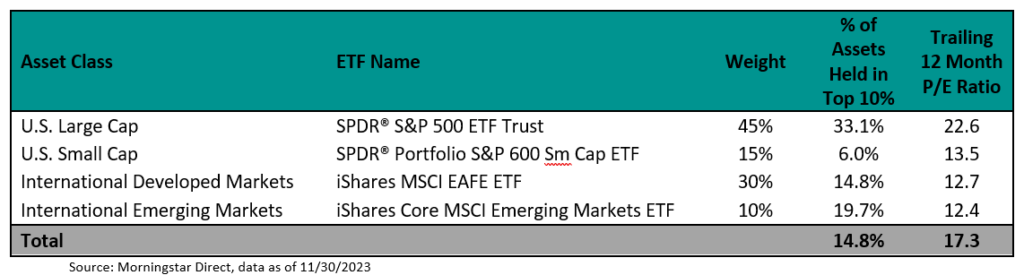

Let’s look at the following illustrative portfolio as an example. By adding exposure to U.S. small cap and international markets, we can reduce exposure to the top 10 holdings in our portfolio by more than half!

In addition to reducing our concentration risk, the example below is also able to bring portfolio-level valuations down too, a potential tailwind to long-term performance.

There is no doubt that holding the largest U.S. companies was the winning play for 2023. Hindsight is always 20/20. However, today’s market conditions now present S&P 500 investors with significant concentration risk and potential for meaningful drawdowns should we enter a period of heightened volatility. Thankfully, a globally diversified approach can help mitigate some of these risks.

While it’s possible that U.S. market leaders may continue their stretch of outperformance over the short term, we wouldn’t put all our eggs in that basket, regardless of how magnificent the returns have been.

This is intended for informational purposes only. You should not assume that any discussion or information contained in this document serves as the receipt of, or as a substitute for, personalized investment advice from Savant. Past performance may not be indicative of future results. Different types of investments involve varying degrees of risk. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.