The Fed Ends the Pause and Raises Interest Rates Again

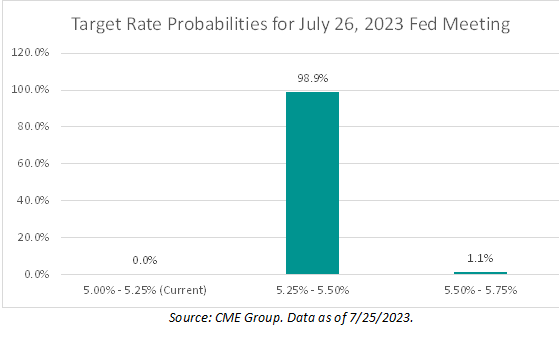

The Federal Open Market Committee concluded its July meeting and announced a 0.25% rate hike. This sets the target for the federal funds rate between 5.25% and 5.50%. The pause we witnessed in June was likely just a brief respite, and the end of it did not come as a surprise to many investors. The chart below shows that the day before the July meeting took place, the CME FedWatch Tool predicted a 98.9% probability that the Fed would raise rates by 0.25%, and a 0.0% probability that the pause would continue.

Source: CME Group. Data as of 7/25/2023. Jerome Powell, the Federal Reserve Chair, delivered testimony to the House Financial Services Committee in June, remarking that, “Nearly all Federal Open Market Committee participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year.”

Why did the Fed even pause rates in the first place and why did they resume the hike shortly thereafter?

The Fed attributed the pause to the effects of tighter household and uncertain business credit conditions. Additionally, the Fed stated that holding the target range steady would allow the Committee to assess additional information and its implications for monetary policy considering how far and how fast they have moved. The Fed had to consider the cumulative tightening of monetary policy, and the lags with which monetary policy affected economic activity as well as inflation.

The Fed ultimately decided to raise rates again because of a stronger-than-expected labor market. Although inflation in June cooled to its slowest pace in two years, wage growth was still very strong. In June, wages and salaries rose 4.4% from a year earlier, employers added over 200,000 jobs, and the unemployment rate changed little at 3.6%.

What might we expect for the remainder of 2023?

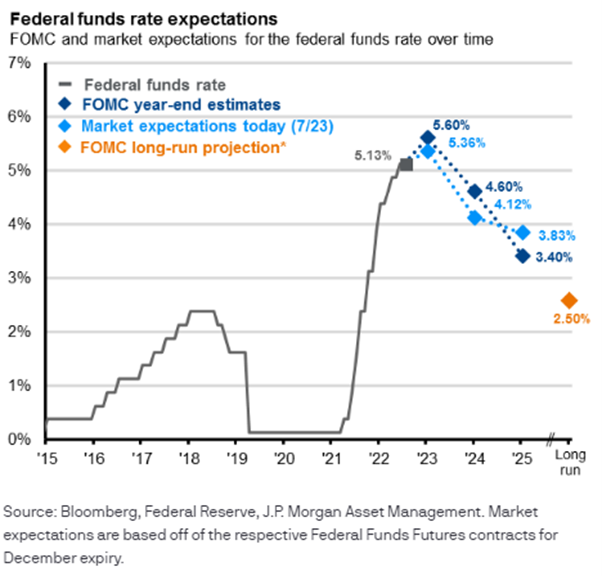

According to the chart below by J.P. Morgan Asset Management, the market is expecting no further rate hikes for the remainder of the year after today. Rates fall on average 2.75% within the first year of cuts but the market appears pessimistic with an outlook of just one full cut expected in Q1 2024 and a cumulative 1.25% in cuts for that year. Of course, we don’t know what will happen during the second half of 2023, or in 2024, so such predictions should always be taken with a grain of salt.

What does this mean for investors?

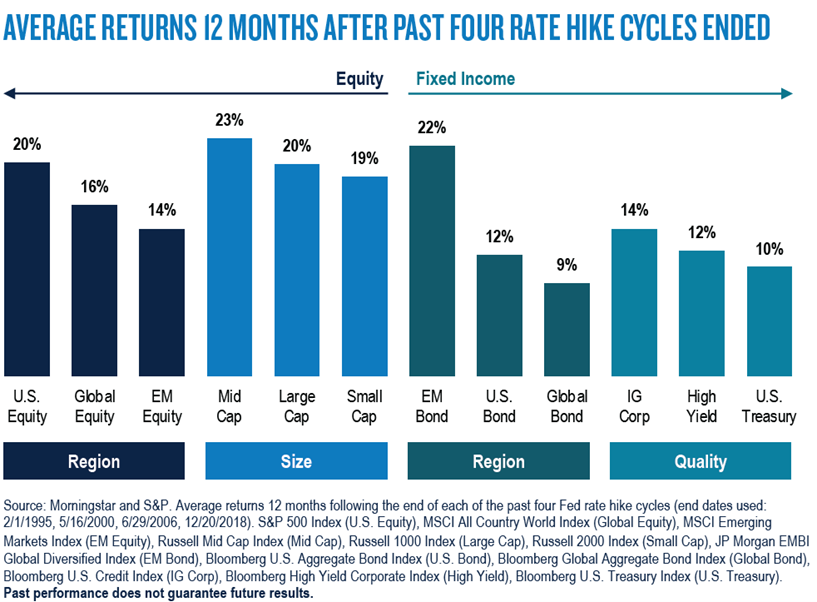

As interest rates decline, investing in long-term assets becomes more appealing. The ends of the past four rate hiking cycles saw market rallies across the spectrum of broad asset classes, as illustrated in the chart below. Investors may also benefit by extending their portfolio’s fixed income duration as, historically, intermediate-term bonds have outperformed short-term bonds, on average, after a Fed hiking cycle ends.

The recent pause in interest rate hikes allowed the Fed to carefully assess economic activity, inflation, and other critical factors affecting the economy. By deciding to raise rates again, the Fed maintained its commitment to delicately balancing economic growth and keeping inflation in check.

As the impact of this rate hike unfolds in the coming months, the Fed will continue to monitor economic indicators to guide any future policy decisions. An advisor can help you remain aware of the evolving interest rate environment so you can continue to make well-informed financial decisions that can help position you for long-term success.

This is intended for informational purposes only and should not be construed as personalized investment or financial advice. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results.