The Tax Impact of Owning A Vacation Home

Many individuals incorporate vacation homes into their financial plans. Owning a vacation home may provide great tax benefits, but the rules can be tricky (and it’s important to avoid common misinformation). This article explores the tax benefits of owning two common types of vacation properties – a personal residence and a mixed-used rental.

Personal Residence

The IRS defines a personal residence as a home that is used for personal purposes for more than the greater of 14 days or 10% of the total rental days.

Tax benefits personal residences may provide:

- Real estate taxes paid – owners may deduct real estate taxes paid on their personal income tax return as an itemized deduction (if they itemize rather than taking the standard deduction).

- Mortgage interest paid – owners may deduct mortgage interest on their personal income tax return as an itemized deduction (if they itemize rather than taking the standard deduction).

- The Augusta Rule – also known as the 14-day rule, it allows taxpayers to earn income on their property without a requirement to pay tax on the income. To qualify, the taxpayer must rent the property for (1) no more than 14 days and (2) personally use the home for at least 14 days during the year (or at least 10% of the total days rented). Vacation homes near major sporting events or music venues can possibly generate a good amount of tax-free income.

Tax Rules to Be Aware Of:

- Real estate taxes (subject to the $10,000 cap) and mortgage interest are only a tax benefit if a taxpayer itemizes. Therefore, if the taxpayer takes the standard deduction, these payments provide no tax benefit. Currently, mortgage interest deductions start to phase out as mortgage balances exceed $750,000 (on all homes combined). Taxpayers with a primary residence and vacation home may be more likely to hit this limit.

- The tax benefit of itemizing is based on your tax rate, so taxpayers in lower tax brackets receive less savings. For instance, a taxpayer who receives an extra $15,000 deduction above the standard deduction in the 24% tax bracket may receive $3,600, while a taxpayer in the 12% bracket may only receive $1,800 in tax savings.

- Augusta Rule – It’s true that the 14-day rule listed above allows taxpayers to earn tax-free income. However, the IRS does not allow the taxpayer to deduct any of the expenses associated with the rental on their tax return.

- Under IRC §121, when a primary residence is sold, married taxpayers may realize the first $500,000 of gains completely tax-free (if they lived in the home for at least two of the last five years). Sometimes real estate agents conflate this rule with personal residences/vacation homes. It is important to note that vacation homes are NOT primary residences, and thus do not qualify for these tax savings.

Mixed-Use Rental

The IRS defines a mixed-use rental as a home that is used for both rental and personal purposes (rented for more than 14 days).

A few points to note:

- In general, taxpayers must divide their total expenses between rental use and personal use (based on the number of days used for each purpose).

- Taxpayers may deduct expenses such as insurance, maintenance, and repairs against rental income (these deductions are not allowed for personal residences).

- Certain expenses such as mortgage interest and real estate tax typically count toward a taxpayer’s itemized deductions. However, many taxpayers are unable to itemize (due to the $10,000 state and local tax cap). Mixed-use rental properties allow taxpayers to deduct a portion of these expenses against rental income.

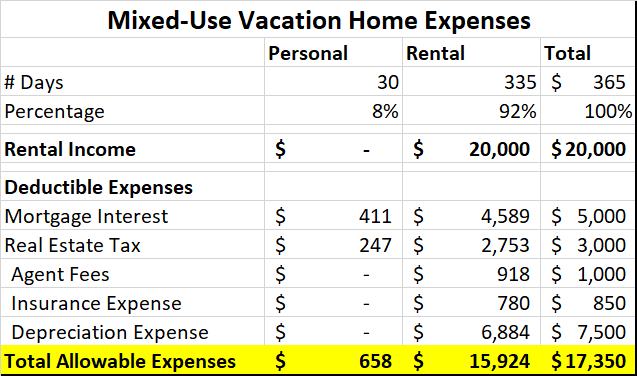

The table below shows a hypothetical example of how mixed-use rental deductions may be calculated:

This hypothetical example is intended for illustrative purposes only

and is not representative of actual results.

Vacation homes can enhance taxpayers’ lifestyles while also helping to build wealth. As with any other form of tax planning, it’s important to see the big picture when it comes to purchasing a vacation home. Talk to your financial advisor and professional tax preparer to explore the true tax impact real estate may have on your financial plan.

Sources: Wall Street Journal: Standard Deduction 2020-2021; IRS: Renting Residential and Vacation Property