Alternative Investments: An Art and a Science

If the last decade’s performance were works of art, stocks might be the Mona Lisa, bonds may be The Starry Night, and alternatives are just fighting for a spot on the refrigerator. While that does not paint the full picture, it does start to sketch out the beginnings of why alternatives may be an integral part of successful portfolios in the decade to come. While incorporating alternative investments into your portfolio is both an art and a science, we will focus on the science in this blog to see whether the data favors the inclusion of alternatives or if investors should stick with the tried and true portfolio of stocks and bonds.

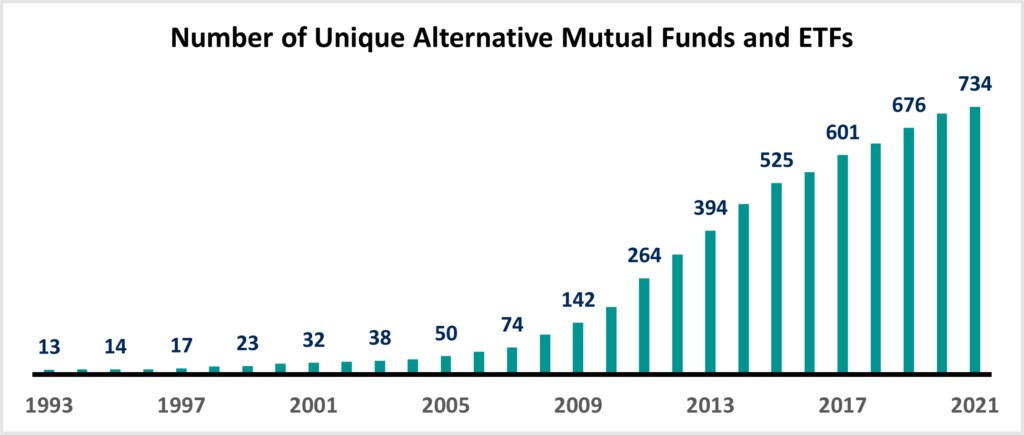

For decades, endowments, pensions, and institutions have utilized alternative investments as a tool to diversify their portfolios beyond traditional stocks and bonds. In the wake of the Great Financial Crisis, Exhibit 1 shows the democratization of these diversifying strategies as asset managers saw a need for individual investors (and a sales opportunity). As shown in the chart below, at the end of 2007, there were only 74 alternative funds available to investors through a mutual fund or an ETF wrapper. Fast forward to the present, and almost ten times that number of “alternative” strategies have been made available to individual investors without accounting for the various share classes of each fund!

Exhibit 1

With that many funds, what is an “alternative” investment?

The answer is somewhat vague. Technically, an alternative investment is simply an asset that does not fall into either the traditional stock or bond categories. That definition leaves the potential number of alternative investment strategies about as infinite as the universe itself. However, we use three objectives to differentiate between a true alternative investment and a sales gimmick:

- There must be intuition and evidence behind long-term positive expected returns for the alternative strategy.

- The strategy should be diversifying to stocks and bonds to enhance return and/or mitigate risk.

- The strategy should provide diversification when you need it. This caveat is often overlooked, but if your diversifying alternative falls 25% when stocks plummet by 25%, did it really strengthen the portfolio?

These objectives are somewhat case-specific. The ultimate test for an individual alternative investment or alternative allocation is whether it improves the probability of success for a financial plan. For the scope of this blog, we’ll focus on trend following, diversified event driven, reinsurance, and real assets. This set of alternatives is unique in that individually, the strategies have properties that protect against adverse scenarios in stocks, bonds, or against inflation to name a few. But they also provide diversification amongst themselves, creating what we believe is a robust bucket of alternative investments.

Long-term Positive Expected Return

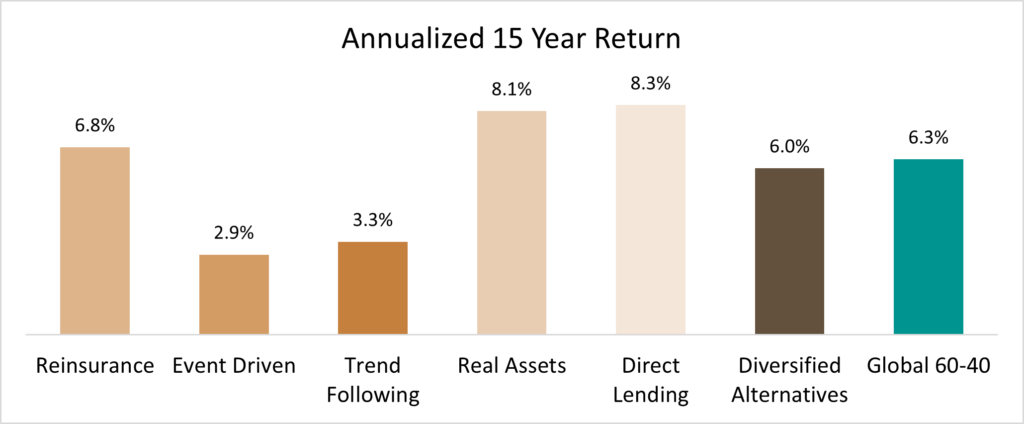

History rarely repeats itself, but it often rhymes. Attempting to guess what returns may be over the next few years is a fool’s errand, but we can form a longer-term forecast by incorporating all the historical data available. In Exhibit 2, empirical evidence illustrates that these alternatives do appear to potentially provide long-term positive returns.

Exhibit 2

Queuing up the perfect segue, over the past twenty years a simple, equal-weight allocation across these alternatives provided a return almost exactly equal to that of the traditional stock-bond portfolio. On its own, you may say, “So what? All that extra work and we got to the same spot!” In the next section we will look to learn whether these alternatives diversify against traditional stock and bond exposures. If they are uncorrelated, meaning the alternatives zig when stock and bonds zag, including alternatives in our portfolio may increase our chances of arriving at a better expected outcome compared to the portfolio of just stocks and bonds.

Diversifying to Stocks and Bonds

For decades, investors have accepted that you buy stocks for growth and bonds diversify some of the risk inherent in stocks to provide protection and income. Portfolios were built with stocks and bonds in part due to their differing return profiles and in part because they were the only two games in town. Enter alternatives. Thinking back to Exhibit 1, we saw that hundreds of alternative strategies are now available to individual investors. While many of these newly available strategies may not be a great fit for your portfolio, a select few may be able to diversify against both stocks and bonds. We can quantify just how well these alternatives zig when stocks or bonds zag through a metric called correlation. A correlation of 1.0 would imply that the two assets move in lockstep and are not diversifying whatsoever. A correlation of 0.5 – 0.8 demonstrates that the assets are moderately diversifying against each other. And a correlation below 0.5 would show that the assets are good diversifiers – with lower correlations implying even better diversifying properties.

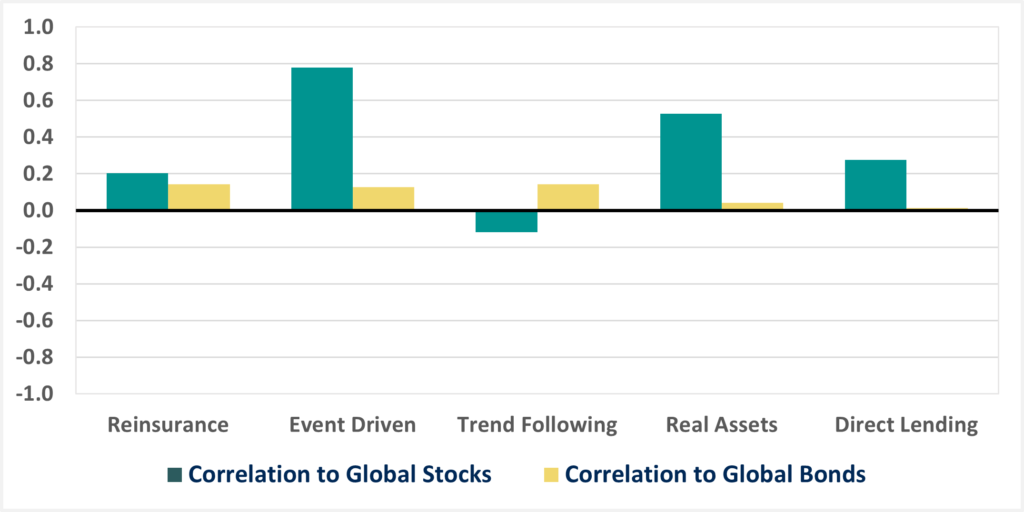

Exhibit 3

Exhibit 3 highlights that each of these alternative investments has tended to provide strong diversification relative to stocks and bonds. Since we can expect these alternative strategies to act differently than traditional stocks and bonds across market environments, Modern Portfolio Theory tells us including these strategies in your portfolio may help increase the expected risk-adjusted return.

Diversification When You Need It

Low correlation, long-term diversifiers are great. But when stocks and bonds rally, there’s no need for diversification. On the flip side, we really need our diversifiers to perform when stocks and bonds struggle. Looking back to the Great Financial Crisis, we can stress test just how these alternative allocations might react during a severe, prolonged recession.

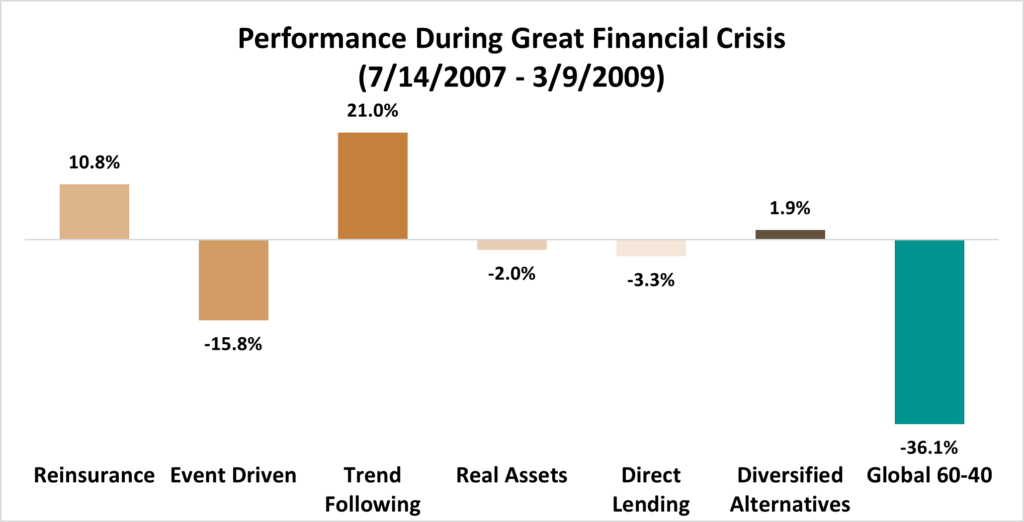

Exhibit 4

Exhibit 4 teaches us a few key lessons. First, alternatives are not a silver bullet. We can not expect alternatives to appreciate when stocks and bonds do but also provide full protection from losses in a bear market. However, in aggregate, we might expect alternatives to hold up fairly well – acting as a ballast to the portfolio in troubling times.

In the hustle and bustle of day-to-day living, investors tend to focus so squarely on short-term returns, but we believe what really matters is the strength of the financial plan. But between elevated valuations for stocks and low interest rates for bonds, financial advisors find themselves between a rock and a hard place with a traditional stock-bond portfolio.

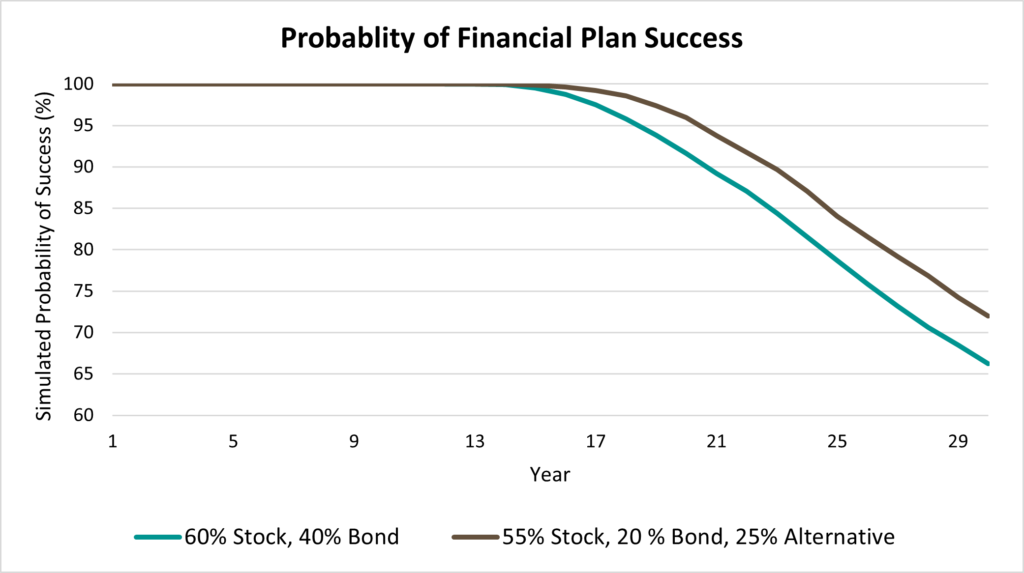

Using long term, historical return and volatility data going back to 1973, we can examine how a simple allocation to alternatives might potentially improve a financial plan’s probability of success. The assumptions in our hypothetical experiment are listed below:

- Probability of Success is defined as having at least $1 in the portfolio.

- The investor starts with a $1 million portfolio and wants to withdraw $65,000 annually (adjusted for 2.5% annual inflation) over the course of their retirement – assumed to be 30 years.

- The investor will choose a basic 60-40 allocation or choose to allocate 20% of the portfolio to alternatives.

Exhibit 5

Exhibit 5 also teaches us a few lessons. As long as you remain diversified and remain invested, minor changes to your allocation are unlikely to make or break your financial plan in the short run. However, over the longer run adding diversifying alternatives to your portfolio may add significant value to your financial plan. In this hypothetical case, the investor who included alternatives in their portfolio was approximately 6% less likely to run out of money before the end of the simulation. 6% may seem like a small margin of victory for the portfolio with alternatives, but when describing the likelihood of not being able to cover living expenses that is a chance many would not be willing to take!

With limited understanding of so many complex-sounding options, it is easy to see why many investors eschew alternative investments altogether. Through an evidence-based process, we can ensure there is intuition behind the expected returns for each alternative strategy and that it is not only diversifying but can be expected to provide diversification when you need it. Sometimes it will be alternatives, other times stocks or bonds that make diversification look like a poorly sketched art project. But taking a step back, we can see that remaining properly diversification just may paint the picture of a lifetime.