When Rates Go Up, Do Stocks Go Down?

Should stock investors worry about changes in interest rates?

With markets near all-time highs, it’s human nature to worry about what might cause the end of this bull market. One common opinion is that as the Fed raises interest rates they may force banks to raise their discount rate or choke economic growth and cause stock prices to plummet. Rather than accepting this belief as fact and awaiting the market’s fate, let’s dig into the numbers and figure out if increasing interest rates really tell us anything about future stock returns.

Research shows that, like stock prices, changes in interest rates and bond prices are largely unpredictable.1 It follows that an investment strategy based on attempting to exploit these sorts of changes isn’t likely to be a fruitful endeavor. Despite the unpredictable nature of interest rate changes, investors may still be curious about what might happen to stocks if interest rates go up.

Unlike bond prices, which tend to go down when yields go up, stock prices might rise or fall with changes in interest rates. For stocks, it can go either way because a stock’s price depends on both future cash flows to investors and the discount rate they apply to those expected cash flows. When interest rates rise, the discount rate may increase, which in turn could cause the price of the stock to fall. However, it is also possible that when interest rates change, expectations about future cash flows expected from holding a stock also change. So, if theory doesn’t tell us what the overall effect should be, the next question is what does the data say?

Recent Research

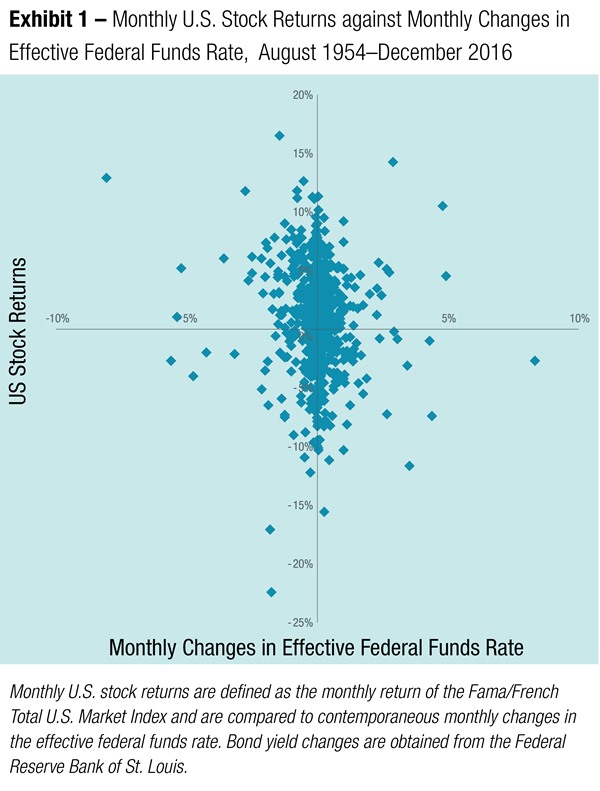

Recent research performed by Wei Dai, Senior Researcher and Vice President at Dimensional Fund Advisors,2 helps provide insight into this question. The research examines the correlation between monthly U.S. stock returns and changes in interest rates. Exhibit 1 shows that while there is a lot of noise in stock returns and no clear pattern, not much of that variation appears to be related to changes in the effective federal funds rate.3

For example, in months when the federal funds rate rose, stock returns were as low as –15.56% and as high as 14.27%. In months when rates fell, returns ranged from –22.41% to 16.52%. Given that there are many other interest rates besides just the federal funds rate, Dai2 also examined longer-term interest rates and found similar results.

So to address our initial question: when rates go up, do stock prices go down? The answer is yes, but only about 40% of the time. In the remaining 60% of months, stock returns were positive. This split between positive and negative returns was about the same when examining all months, not just those in which rates went up. In other words, there is not a clear link between stock returns and interest rate changes.

Conclusion

There’s no evidence that investors can reliably predict changes in interest rates. Even with perfect knowledge of what will happen with future interest rate changes, this information provides little guidance about subsequent stock returns. We believe that rather than testing your odds on what may best be described as a guessing game, maintaining a portfolio that is tailored to your risk tolerance and globally diversified across stocks, bonds, and alternatives should prove beneficial in the long run. Staying invested and avoiding the temptation to make changes based on short-term predictions may increase the likelihood of consistently capturing what the stock market has to offer.

End Notes

1 See, for example, Fama 1976, Fama 1984, Fama and Bliss 1987, Campbell and Shiller 1991, and Duffee 2002.

2 Wei Dai, “Interest Rates and Equity Returns” (Dimensional Fund Advisors, April 2017).

3 The federal funds rate is the interest rate at which depository institutions lend funds maintained at the Federal Reserve to another depository institution overnight.

Please remember that past performance is not indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Savant Capital Management), or any non-investment related content, made reference to directly or indirectly in this newsletter will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice from Savant Capital Management. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to their individual situation, they are encouraged to consult with the professional advisor of their choosing.