Top 7 Ways to Prepare for the New Tax Law

What have we learned since major tax reform was enacted in late 2017? One thing is for sure: the learning has just begun! Tax practitioners and planners across the nation are working with the IRS on obtaining further guidance and clarity on the complex changes embedded within the legislation.

Even though the law is new and big changes were implemented, there are proactive steps you can take now to prepare for the changes (which, for the most part, were effective January 1, 2018).

Here are the top 7 strategies for you to consider. Keep in mind that some strategies may not apply to you directly.

#1: Be more deliberate and strategic with your tax planning.

You may have heard this before, but with a larger standard deduction, many people may no longer benefit from itemizing. In order to get over the standard deduction threshold ($12,000 for single filers and $24,000 for joint filers), consider grouping three to five years’ worth of charitable donations into one year. This strategy could be even more advantageous in a higher income year. Talk to your advisor about setting up a donor advised fund to host these larger donations.

Another major change was that Roth conversions completed in 2018 or later years can no longer be “undone.” Be aware of the short-term tax impact, as well as the long-term strategy, behind the Roth conversion. Again, discuss this with your advisor.

#2: Get personalized tax advice.

Are you working? Have you noticed that your paycheck is a bit bigger? The tax withholding rates have been lowered to reflect the new tax rates. Review your wage withholding so that you are not surprised come April 2019!

For those without wage income, it is usually a good idea to run through a few scenarios with your advisor to better understand self-employment income, capital gain income, and retirement income, as well as the tax effects of those income types.

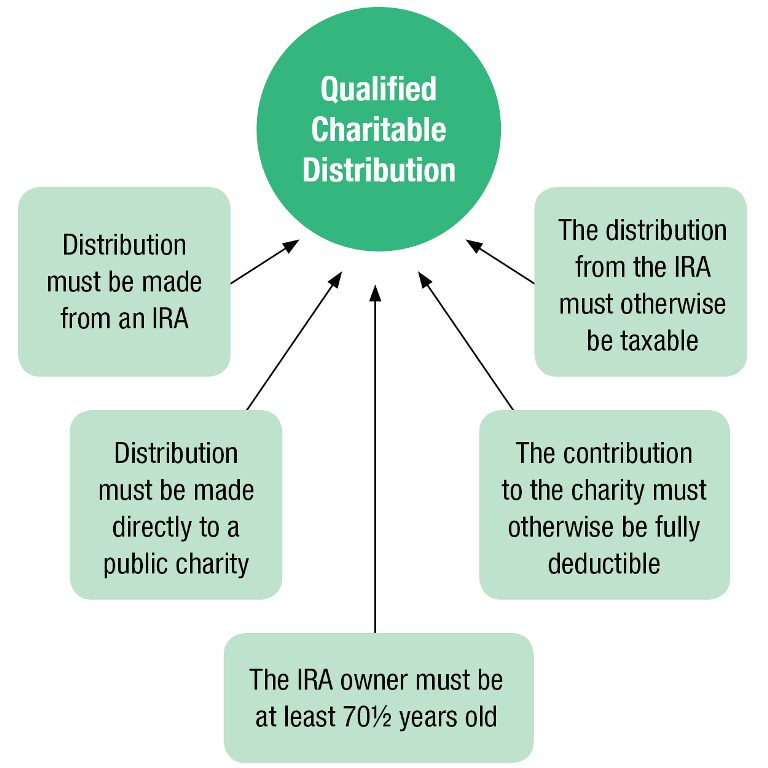

#3: Consider a QCD.

If you are over the age of 70 1/2, you can still make a Qualified Charitable Distribution (QCD) from your IRA (up to $100,000). If you are no longer able to itemize, taking income off the front page of your tax return could mean a bigger benefit than just lowering your taxes. For example, because these direct charitable contributions lower your adjusted gross income (AGI), they might also help lower your Medicare premiums.

#4: Review your business entity structure.

With the new legislation, there is now a 20% pass-through deduction for sole proprietors (filing Schedule C), partners in a partnership, and shareholders in an S-Corp. If you have a business, discuss the entity structure – and whether or not you should consider any changes – with your advisor. There are income limits to consider, as well as limitations based on the industry in which your business operates. The deduction is calculated at the individual level, so you and another partner could have very different deduction calculations. Of course, this is another reason for #2 – get personalized advice!

#5: Understand the limits.

If you end up taking the standard deduction, the new State and Local Tax (SALT) limitation of $10,000 does not impact you. However, if you are itemizing, this limitation will apply. Taxpayers are now only able to deduct up to a combined $10,000 in state income taxes (or sales taxes) and property taxes. Be sure to talk with your advisor about how to structure and strategically maximize your SALT deduction.

#6: Remember federal changes do not mean state changes!

Taxpayers beware! The federal 529 law now allows you to withdraw up to $10,000 per student per year for qualifying K-12 education expenses from a 529 plan. However, not all states have updated their regulations to follow the federal changes. Illinois, for example, has stated that if you withdraw funds for this purpose, you would have to pay back any state tax benefits received for 529 plan contributions. Do not assume that since there was a federal change, your state taxes will also change in the same manner. And, if you are considering moving to a different state, discuss all the ramifications of this move with your advisor.

#7: Get organized.

There is no time like the present to get things in order. Although it seems as though this tax season just ended, there are things you can do now to improve next year’s tax filing. Together with your advisor, determine if you will take the standard deduction or itemize. If itemizing, make sure to collect and organize receipts for charitable contributions and medical receipts (if you anticipate large out-of-pocket medical expenses). If you own a business, keep detailed records of business expenses in order to substantiate the deductions. Keeping your files in order now can mean fewer headaches later on – for both you and your tax preparer!

Sources: Tax Cuts and Jobs Act, H.R. 1, 115th Congress (2017); AICPA.org Tax Reform Overview: Getting to the heart of tax reform (2018); Office of Illinois State Treasurer. State Treasurer Frerichs Cautions Families on Tax Penalty Risk (2018).

This is intended for informational purposes only and should not be construed as investment, tax or financial advice. Please consult with your investment, tax, and financial professionals regarding your specific situation.