The Zero-Cost Collar: A Strategy to Limit Your Losses…and Gains

As bull markets age and continue toward new record highs, it is human nature to look for a strategy to protect your investment portfolio from losses. A zero-cost collar is an option-based strategy for investors who are looking for ways to possibly “insure” their stock portfolio against losses. The gist of this option strategy is that you purchase a put option to limit your losses if the market declines while simultaneously selling a call option with a premium earned equal to the amount paid for the put—making the transaction costless. The drawback is that the call option sold limits the potential gain on the investment you are trying to protect. Understanding this shortcoming is pivotal to comprehending the strategy.

What is an Option?

An option is a contract that gives the option holder the right, but not the obligation, to buy or sell the underlying asset at a pre-specified price for the duration of the option contract. The option holder (buyer) pays a fee, the premium, to the seller of the option contract. Buying a put option gives you the right to sell a security at a specific price (the strike price) at any time until the option expires. This acts as a limit to potential losses. The holder of a call option has the right to buy a security at a set price until a specific future date. By selling a call option on a security, potential gains are limited since the counterparty will exercise it once the security’s price exceeds the option’s strike price.

The Zero-Cost Collar in Action

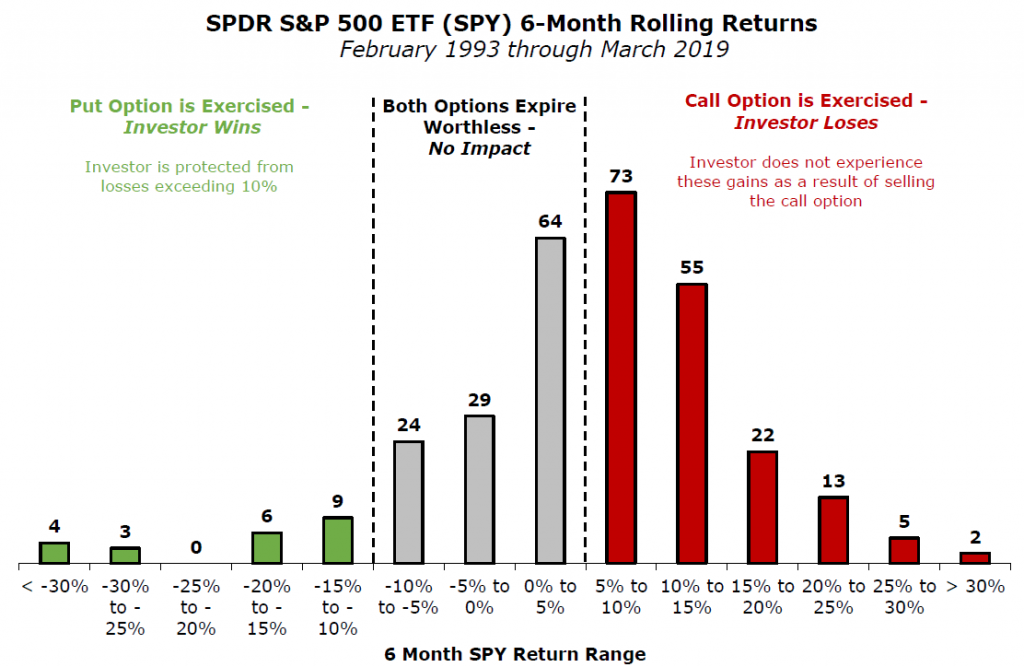

Let’s dig into this strategy with an example: An investor wishes to protect his investment in an S&P 500 index fund (SPY) by implementing a zero-cost collar strategy. To carry this out, the investor buys a six-month put option that limits losses to 10% and sells a six-month call option on the same fund that limits any gain to 5%. This asymmetric payoff profile is typically necessary in order to ensure the premium earned from selling the call option matches the premium paid to purchase the put option. Therefore, this tactic is referred to as costless since the premium from the call option sold brought in proceeds equal to the cost of the put option bought. However, understanding the true cost, including opportunity costs, requires analyzing the payoff profile of a collar strategy.

If the fund ends the six-month term between a 10% loss and a 5% gain, this zero-cost collar strategy will have no impact on performance, positively or negatively. If the fund loses more than 10% during the six months prior to both options’ expiry, our investor’s losses are capped at 10%. However, if the fund gains more than 5%, this strategy costs the investor any potential investment gain above 5%.

Drawbacks of a Zero-Cost Collar Strategy

- The transaction might be cashless, but the opportunity cost of missed investment gains could be very high.

- Determining how long to leave the collar in place is pure market-timing – a notoriously precarious task.

- Option payoff profiles are nonlinear, meaning that the range of outcomes can be asymmetric. Our zero-cost collar exposes the investor to more potential losses than gains.

- Depending on the term length of the option, any gains may be taxed at your ordinary income rate rather than long-term capital gain rate. The zero-cost collar strategy above “pays off” if the market falls more than 10%, but the marginal benefit of this payoff decreases as taxes must paid on the gains of the put option.

- By nature, option strategies are complex. Collar strategies may also pose basis risk as utilizing options on one index ETF would be an imperfect hedge for a globally diversified portfolio.

Today’s market environment taps into common behavioral biases among investors, increasing the temptation to resort to complex option strategies to “save” their portfolio. But it is important to consider that option strategies are largely focused on short-term outcomes, while evidence has shown that investors have a terrible track record of forecasting markets over a short time horizon. As markets are extremely efficient and tend to rise in the long run, much more often it is beneficial to remain diversified and stay the course.

The Gritty Details

Revisiting our earlier example, let’s look at how this zero-cost collar would have paid off throughout history. Just how often has the S&P 500 lost more than 10% in a six-month period and how often has it gained more than 5%? We will use the SPDR S&P 500 ETF (Ticker: SPY) as our proxy for the S&P 500. This ETF is popular among options traders because of the volume in its options chain. With a fund inception during January 1993, we can analyze every rolling six-month period to date to better understand how frequently this strategy actually benefits investors. Based on monthly returns from 1993 through March 2019, SPY fell more than 10% in only 7.1% of our rolling six-month periods. On the flip side, SPY’s return exceeded 5% in 55% of the periods we studied – meaning the investor would have missed out on valuable gains over half the time! The six-month returns fell between -10% and 5% approximately 37.9% of the time, meaning this strategy would have had no impact on performance during these periods.

But what about the magnitude of the losses avoided? On average, when the put option would have been exercised, it would have benefited the investor to the tune of 9.9%. However, historically, this protection would have kicked in less than 10% of the time. If you could protect yourself from a few big losses and only give up a little gain each time, this strategy would work. However, the nature of a zero-cost collar forces the upside potential to be capped relative to the downside protection. More than half of the time the call option would have been exercised, costing the investor an average of 7.3% each time. The numbers have simply not been in favor of this strategy. Furthermore, in order to maintain the zero-cost structure, investors who desire more upside potential will have to accept even more downside risk relative to the marginal upside added.

Takeaways

Today’s 24-hour media barrage only increases the allure of exotic strategies intended to limit downside. Unfortunately, there is no free lunch in investing, and the opportunity cost of limiting a portfolio’s upside can have ramifications far worse than any bear market.

Until we find a magic market-timing crystal ball, the best approach to minimize risk remains global diversification across stocks, bonds, and alternatives.

Source: Morningstar Direct

This is intended for educational purposes only and should not be construed as personalized investment advice. Please consult your investment professional regarding your specific circumstances.