Summer Games: Mid-Year Market Update

Did you know there are nearly 50 sports included in the 2020 Tokyo Summer Olympics? (Yes, that’s correct – the 2020 Olympics are taking place in 2021.) Over 15,000 Olympic and Paralympic athletes are competing from July 23rd through August 8th. Skateboarding, karate, surfing, sport climbing, and BMX freestyle are some of the newer sports added to the Olympics in recent years. We will use this exciting global tradition to work our way through a mid-year update on financial markets and the economy.

Marathon

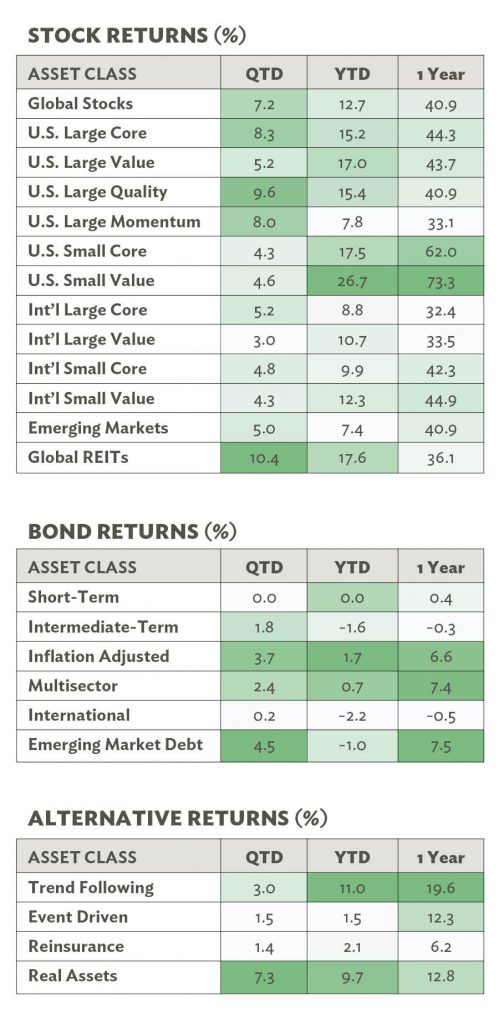

What started out as an emergent trend in the fourth quarter of 2020 has turned into a full-fledged long-distance sprint for U.S. small value, up 26.7% year-to-date in 2021 and returning 73.3% over the past year. U.S. large value gets the silver medal with its 17% year-to-date return. Many predicted the “death” of value stocks over the past few years, similar to what was said in the late 90s when growth stocks dominated for a period of time. Of course, this was concurrent with value stocks pricing historically cheap relative to their growth stock counterparts. While that told us nothing about what might happen in the near term, history demonstrates that periods of such “cheapness” are typically followed by strong relative returns of value relative to growth.

Our evidence-based investing approach tells us that systematic value investing does not always work, and investors who want to earn the long-term premium associated with owning value stocks must be willing to stick with the strategy during periods of underperformance. A value orientation is akin to running a marathon – not a 100-meter dash. As such, investors should adopt the mindset of Aesop’s tortoise rather than the hare.

Tri-ALT-hlon

The triathlon illustrates a mix of ALTernative asset classes that each offer unique characteristics – much like the run, bike, and swim circuits. The alternative asset class returns in 2021 are positive across the board yet have performed that way without any correlation. The three main events in 2021 are:

- Real assets (up 9.7%) benefiting from a rebound in data usage via infrastructure, recovering transportation, and improved farmland fundamentals with higher food prices

- Trend following (up 11.0%) benefiting from the trends in fixed income and commodities; and

- Reinsurance (up 2.1%) which has collected more premiums than paid out losses.

Surfing

Riding the wave is how investors may feel about bonds in 2021. Relative to stocks, bond investors had smooth riding for the past 40 years with the Barclays Aggregate Bond Index only finishing with a negative annual return three times since 1977. This year, however, core bonds are down 2.3% due to rising interest rates. The main culprit appears to be COVID-related government stimulus sparking fears that inflation is coming. While it’s easy to claim bonds serve no purpose today given low yields, we think they still serve as a key tenant in portfolios. Bonds provide a ballast to stock market volatility and can serve as a source of liquidity in a portfolio.

Tennis

The back-and-forth volleying activity in tennis is reminiscent of the tug-of-war between retail speculators and hedge fund players during the first half of 2021. The short squeezes and mania-driven trading have given witness to extreme volatility in names like GameStop, AMC, and other “meme stocks” favored by the Reddit-trading community.

What makes investing so fascinating is that unlike many other competitive pursuits, the pros and amateurs are on the field at the same time. And sometimes the amateurs actually win! The temptation to act during these fleeting periods of market euphoria is strong. Yet as powerful as FOMO can be, the great thing about any game is that you don’t have to play. You can always choose to spectate from the sidelines instead of speculating on the court.

BMX Freestyle

Just as new events are added to the Olympics over time, investors participate in a growing spectrum of asset classes. This can manifest in a couple of ways. Sometimes innovative fund structures, like interval funds, democratize existing asset classes to a broader audience.

Other times, it is the advent of entirely new asset classes, as has been the case with cryptocurrencies over the past decade. The rising interest in Bitcoin and other digital assets has given speculative investors new ways to “freestyle” with their portfolios. In the same way BMX riders wear helmets, crypto-curious investors should exercise caution and prepare for a bumpy ride.

Hurdles

They say markets climb a wall of worry. In sticking with our summer games analogies, we could also say they jump a series of hurdles as they make their way around the track.

Today, there are several hurdles present in our global economy.

- Rising interest rates could continue to test the patience of bond investors. Higher rates are ultimately a net-positive, but the transition getting there could cause some short-term pain.

- Inflation concerns are top of mind for many, given the unprecedented fiscal and monetary stimulus we’ve seen already, with more potentially on the way. That said, it seems more likely that inflationary pressures will be transitory in nature.

- Lastly, while the vaccine rollout in the U.S. has been a relative success, other countries have encountered challenges and COVID-19 is still a looming concern. An uneven economic recovery and reopening could keep a lid on coordinated global growth.

Savant does not recommend or advocate the purchase of, or investment in, cryptocurrencies. Savant considers such an investment to be speculative. Those who invest in cryptocurrency must be prepared for the potential for liquidity constraints, extreme price volatility, and complete loss of principal.

Source: Morningstar Direct. Indexes and returns ending 6/30/2021 referenced in article: Global Stocks-MSCI ACWI IMI NR; U.S. Large Core-CRSP U.S. Total Market; U.S. Large Value-Russell 1000 Value; U.S. Large Quality-MSCI USA Sector Neutral Quality; U.S. Large Momentum-MSCI USA Momentum; U.S. Small Core-Russell 2000; U.S. Small Value-Russell 2000 Value; Int’l Large Core-MSCI EAFE NR; Int’l Large Value-MSCI EAFE Value NR; Int’l Small Core-MSCI World Ex USA Small Cap NR; Int’l Small Value-MSCI World Ex USA Small Value NR; Emerging Markets-MSCI EM NR; Global REITs-S&P Global REIT; Short-term Bonds-BBgBarc U.S. Govt/Credit 1-3 Yr; Intermediate-Term Bonds-BBgBarc U.S. Agg Bond; Inflation-Adjusted Bonds-ICE BofA U.S. Infln-Lnkd Trsy; Multi-Sector Bonds-Multi-Sector (blended index); Int’l Bonds-JPM GBI Global Ex U.S. TR Hdg; Emerging Markets Debt-JPM EMBI Global Core; Trend Following-Credit Suisse Mgd Futures Liquid; Event Driven-IQ Hedge Event Driven; Reinsurance-SwissRe Global Cat Bond; Real Assets-Real Assets (blended index). Blended indexes available upon request.