Serenity Now

In an all-time classic episode of Seinfeld, George’s father Frank Costanza begins reciting a mantra – “Serenity Now” – to control his blood pressure when he gets angry. Hilarity ensues.

A notable scene in the episode occurs between George and his childhood nemesis, Lloyd Braun.

Lloyd: “You know, you should tell your dad that ‘serenity now’ thing doesn’t work. It just bottles up the anger, and eventually, you blow.”

George: “What do you know? You were in the nuthouse.”

Lloyd: “What do you think put me there? Serenity now. Insanity later.”

There is a kernel of truth here. A mantra has no meaning if not accompanied by corresponding actions and behavior.

So how do we, as investors, find serenity in a world that makes it increasingly difficult to do so?

I recently read a new investing book from AQR’s Antti Ilmanen, Investing Amid Low Expected Returns. This fantastic book opens with a reference to The Serenity Prayer – words that may ring true for investors in today’s challenging return environment:

“God, grant me the serenity to accept the things I cannot change, courage to change the things I can, and wisdom to know the difference.” – American theologian Reinhold Niebuhr

As Antti notes, “Serenity is about accepting reality as it is and doing one’s best with it. Serenity is not the same as wishful thinking or unrealistic optimism.”

What is our reality today and how can we parse between the things we have control over versus the things we do not?

The laundry list of worrisome news in 2022 is exhausting – the highest inflation in decades, the Russia-Ukraine war, a lingering pandemic, labor shortages, supply chain bottlenecks, Fed tightening, COVID-related lockdowns in China. There’s so much distracting us and leading us to second guess our portfolios. Doing SOMETHING always feels like a natural release valve.

But everything referenced above tells us only where we’ve been and where we are, not where we’re going. In other words, by the time you read about it in the paper, hear it on the news, or receive an alert to your smartphone, it’s likely already embedded in market prices and thus of little utility to us as investors in forward-looking markets.

One only needs to look at this year’s damage to stocks and bonds to see efficient markets in action, swiftly repricing assets to reflect new risks.

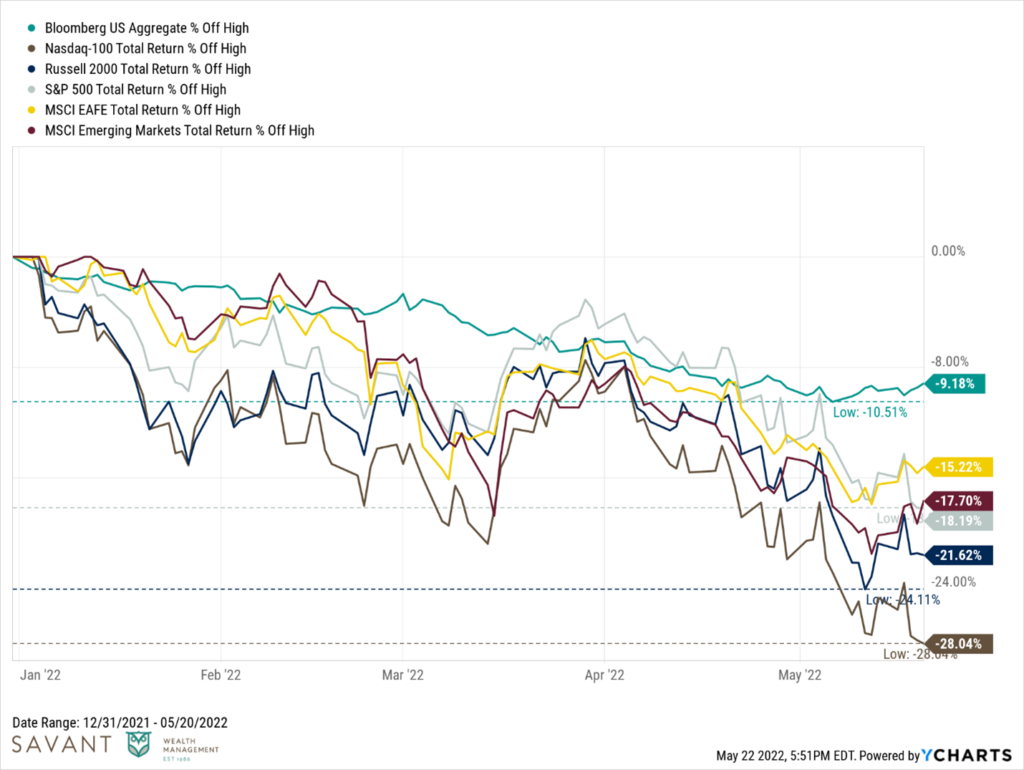

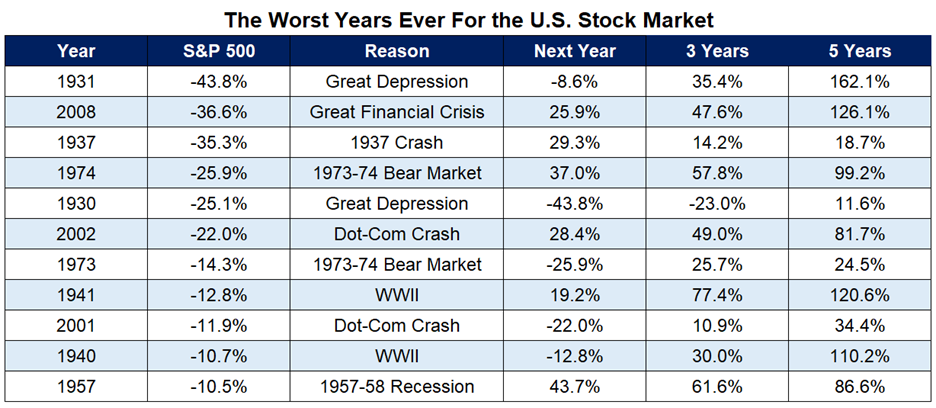

Stocks are in, or approaching, bear market territory depending on your index of choice. If 2022 ended today, it would be among the ten worst calendar years on record for the U.S. stock market. Bonds, typically a source of stability and ballast to a portfolio during periods of equity volatility, are down nearly 10 percent and on pace for the worst calendar year since the inception of the Bloomberg Aggregate Bond Index in 1976.

As bad as things feel right now, we must remind ourselves of what we cannot predict or control.

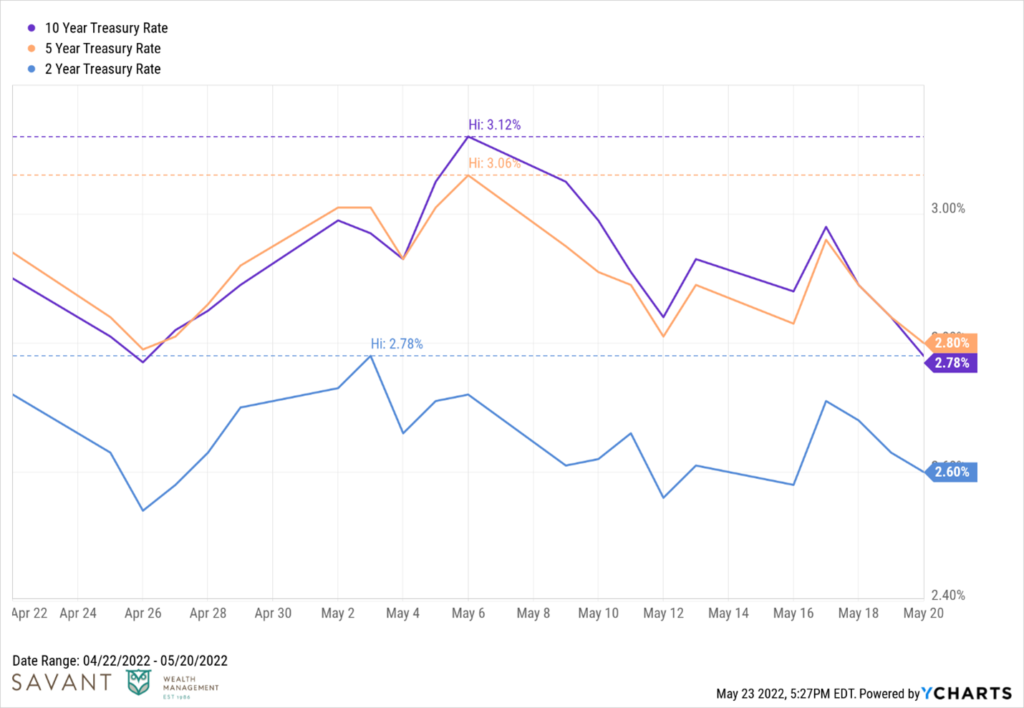

We can’t control the direction or path of interest rates. The market expects a Fed funds rate of 2.75-3% by the end of the year. Where bonds go from here will depend in large part on whether the Fed is more (or less) aggressive in this rate hike cycle than what is being priced in. For what it is worth, rates have recently taken a pause – even if temporarily – from their upward trend.

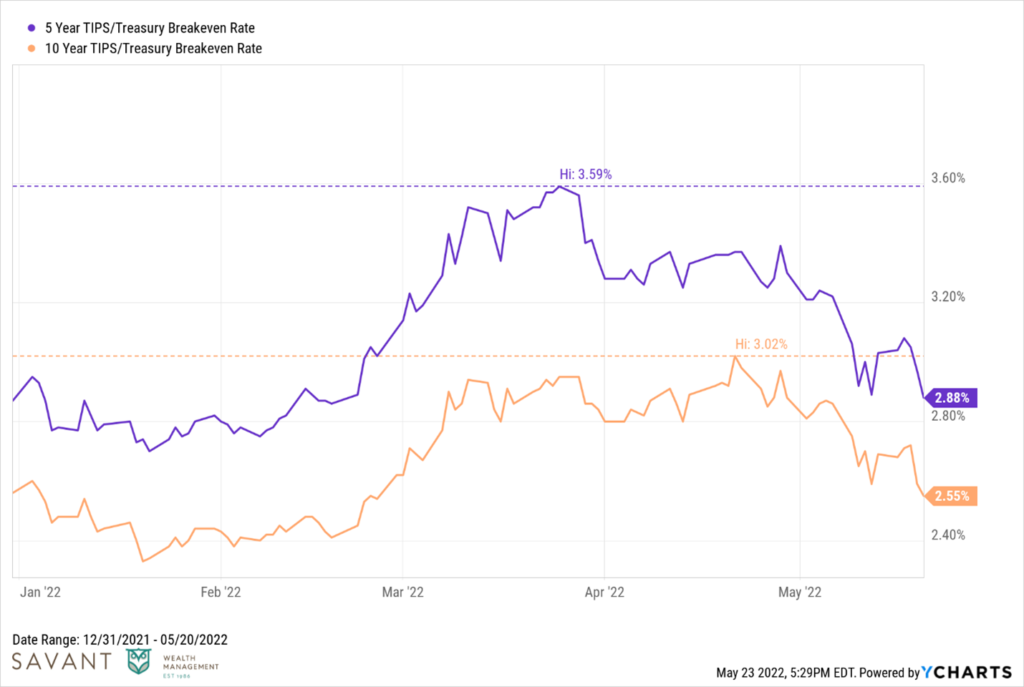

We can’t predict where inflation goes from here, though there are some early signs that things are beginning to moderate. Market-implied expectations for inflation for the next five and 10 years, a.k.a. breakeven rates, have come down dramatically from their highs in April.

We can’t know ahead of time how much farther stocks might fall, but the odds would favor us being closer to the bottom than the top. And historically the returns three to five years out after a really bad year have been meaningfully positive, on average.

Source: A Wealth of Common Sense

We can’t forecast the timing, duration, and magnitude of a recession. And even if we could, it probably wouldn’t give us any valuable information on which to base trades. Recessions are not fun for anybody, but they are an inevitable part of the economic cycle. Whether we like it or not, there will always be one on the horizon. The odds seem higher now that a recession may be approaching relatively soon (if we’re not in it already). The stock market always has and always will move well ahead of a recession’s beginning and end.

And now, a list of things we CAN control …

Blocking and Tackling

While the best action is often inaction during bouts of volatility, that doesn’t mean we’re sitting on our hands at Savant. While we accept the things we cannot change, we’re confident about where we can add value through regular monitoring and maintenance of our client portfolios.

When the markets hand us lemons, we do our best to make some lemonade through periodic rebalancing and tax-loss harvesting.

We can’t dictate the direction of interest rates. Nor can we foresee which extreme the animal spirits of stock market participants will swing today or tomorrow.

But we can make sure our clients’ portfolios maintain alignment with their personal risk preferences. And we can systematically take advantage of discounted prices offered by the market. And we can capture tax losses to improve portfolio tax efficiency now and in the future.

Avoiding Potholes

Stay-at-home stocks. Meme stocks. Crypto. IPOs. SPACs. Thematic Investing. “FANMAG.”

Whatever your fancy, there was no shortage of seductive narratives and speculative itches to scratch in 2020 and early 2021. Enough overnight riches were being made to give even the most cautious investors a little bit of FOMO (fear of missing out).

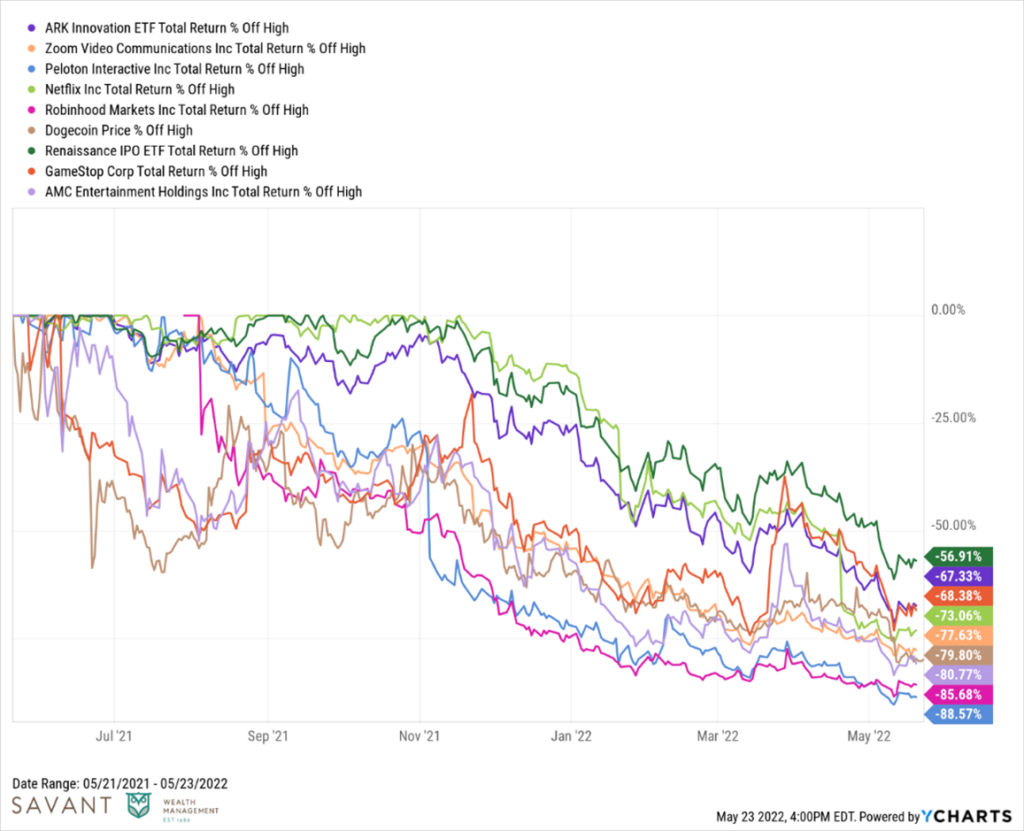

And then the movie ended as obviously as many predicted. The excesses were squeezed out of the system like a wet sponge with each successive mini-bubble bursting. Some of the damage is surveyed in the chart below highlighting the declines of many of yesterday’s speculative investment darlings.

By sidestepping these inevitable potholes and instead investing in a diversified portfolio – as boring as it can be at times – you’ve won by not losing. FOMO is tough to avoid, but sometimes GOMO – the gratitude of missing out – can be quite rewarding.

Silver Linings

While much attention gets paid to the negative, it’s important to highlight some of the positives as well.

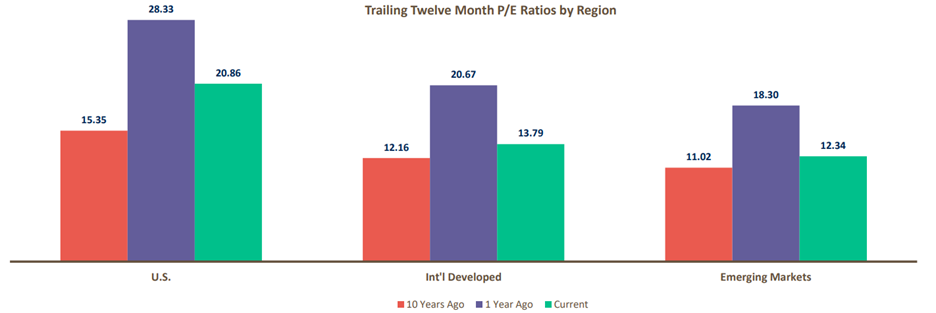

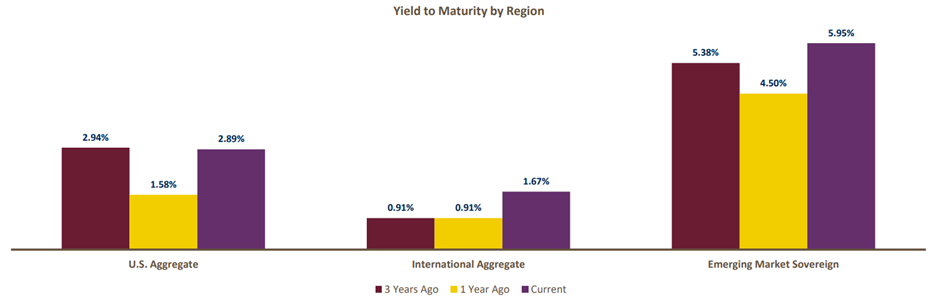

Two of the most common investor complaints in recent years have been that bond yields are too low and stock valuations too rich. While neither is exactly at “normal” levels (whatever that means), they are both looking markedly better than they did at the inception of the year.

Trailing 12-month P/E ratios for U.S., International Developed, and Emerging Market stocks are now closer to where they were 10 years ago than where they were a year ago.

Source: MarketWise. Data as of 3/31/2022.

Source: MarketWise. Data as of 3/31/2022.

In addition to higher expected returns for broad asset classes, there have been some bright spots this year – both in absolute and relative terms.

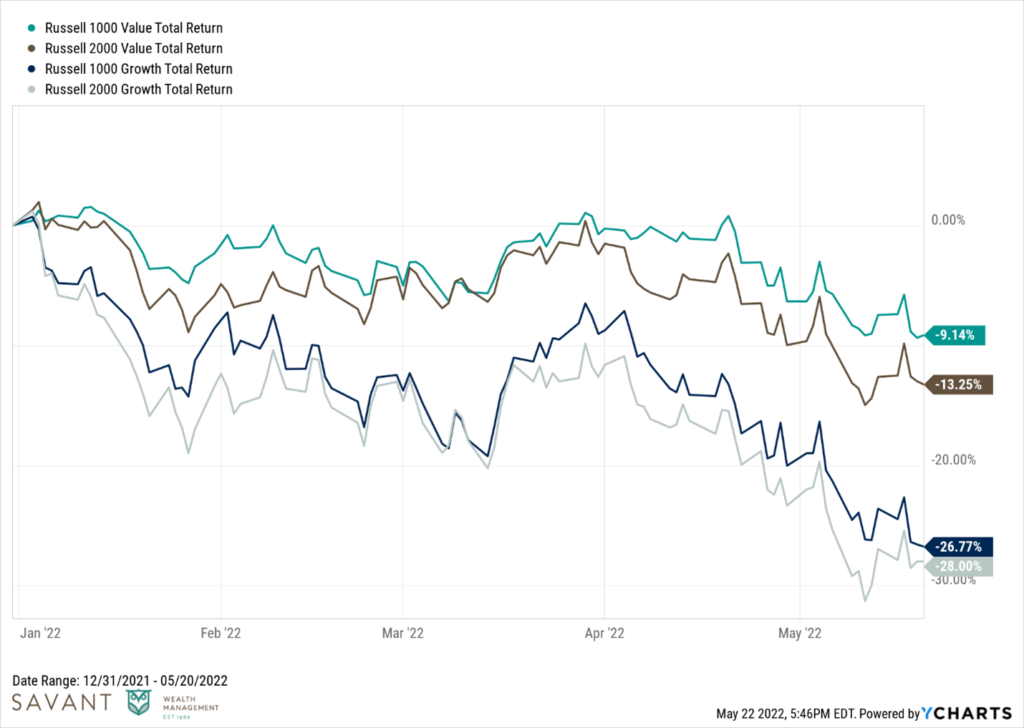

The value style of investing in stocks was out of favor for much of the 2010s. While that dry spell seems to be over, value stocks are weathering the interest rate/inflation storm much better than their pricier growth counterparts. Tilting towards value, something we firmly believe in at Savant, hasn’t completely shielded losses, but it has certainly helped cushion the blow as evidenced below.

Lastly, we haven’t been shy about our conviction that allocations to alternative investments will play a pivotal role in improving portfolio outcomes in the years ahead. Heck, I even wrote a book about it. That said, alternatives require patience just like any other long-term investment. And that patience seems to be paying off, with many alternative asset classes behaving in an uncorrelated fashion and delivering positive returns in an environment where seemingly everything else is in the red.

At some point, inflation will moderate, interest rates will stop increasing, and stock prices will stop falling. The news won’t be good, but it will be less bad. The line between despair and hope, between darkness and dawn, is thin and grey.

We can’t pinpoint exactly when, but eventually, that day will come.

Until it does, all we can do is invest with serenity through our actions (or inactions). A good night’s sleep, a healthy dose of humility, and some patience can go a long way in preventing serenity now from becoming insanity later.

Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your account holdings correspond directly to any comparative indices or categories.