Portfolio Spotlight: Event Driven Investing

Trick-or-treaters often judge the success of their Halloween adventures by the depth and breadth of candy collected at evening’s end. Yet while the contents of their bags contain an eclectic mix of treats, they all share one common thread: lots of sugar. Similarly, there are several different investing strategies that can be classified under the broad category of Event Driven, but they all primarily seek to capture the same underlying theme.

As the name implies, Event Driven investment strategies trade around corporate events that create temporary pricing inefficiencies within markets. These inefficiencies often arise due to supply and demand imbalances that attract a group of investors, known as arbitrageurs, who expect to collect a return premium for providing liquidity around these events and bridging the supply/demand gap. Historically, this Liquidity Risk Premium has been profitable over time and difficult to replicate via traditional investments.

The most common example of an Event Driven strategy is Merger Arbitrage. When public companies are acquired, the target company’s stock typically trades higher after the deal is announced but below the amount offered by the acquirer. This reflects a level of uncertainty that the deal will ultimately close. It provides an opportunity for event-driven investors to purchase the target company’s stock, often simultaneously shorting the acquirer’s stock to hedge out the market risk, and generate a positive return once the deal presumably closes. While any one deal may or may not close, pursuing a diversified set of these transactions has been shown to produce positive returns on average and over time irrespective of the direction of stock and bond markets.

There are many other examples of corporate events and capital market financing activities that create opportunities for event-driven investors, including bankruptcies, convertible bond issuance, spin-offs, and special purpose acquisition companies (SPACs). Each of these events can produce temporary price inefficiencies due to uncertainty or specific market conditions such as a lack of liquidity.

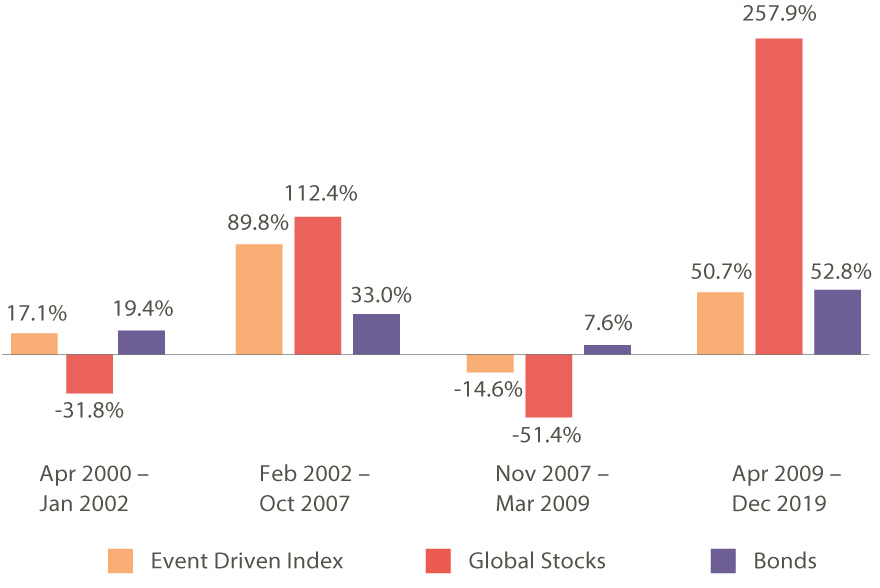

We all have our favorite candy. But that doesn’t mean we can’t also enjoy other sweet treats. Some Event Driven investors may feel inclined to stick with one strategy like Merger Arbitrage, but we would argue that a more diversified approach allows you to sample all the different flavors while still capturing the alternative risk premium that comes from being a liquidity provider. As shown in Figure 1, a diversified Event Driven strategy has offered lower downside risk than stocks during significant drawdowns while also participating on the upside during periods of economic growth and stock market gains.

Figure 1: Total Returns over Market Cycles

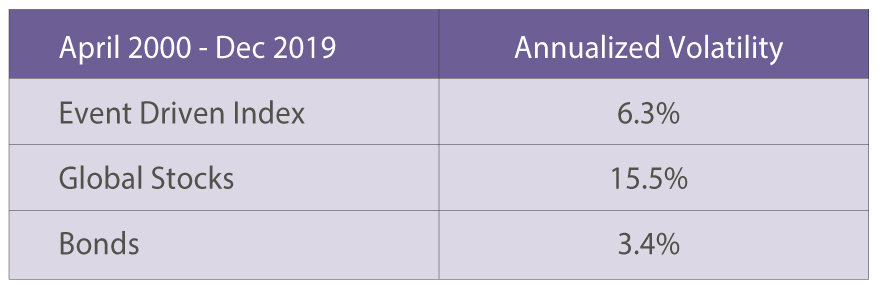

Figure 2 shows that diversified Event Driven strategies have done this with substantially less volatility than stocks over the past two business cycles.

Figure 2: Historical Volatility by Asset Class

The risk and return profile of this asset class provides an ideal complement to a traditional portfolio of stocks and bonds by adding an uncorrelated “flavor” that has the potential to improve overall risk-adjusted returns. And unlike the morning after Halloween, this one won’t leave you with a stomach ache.