Ask Meaningful Questions: Bonds and Alternatives

A Continuation of Step Two of Evidence-Based Investing

In science, the questions are as important as the answers. The goal of evidence-based investing (EBI) is to leverage our collective knowledge of risk and return to maximize the likelihood of achieving desired outcomes. In our whitepaper, “Evidence-Based Investing: A Scientific Framework for the Art of Investing,” asking meaningful questions is a critical part of the process to help you make solid and fruitful decisions about your investments. And it involves a four-step process.

We kicked off step two of the EBI process by answering questions about international and factor investing. In this blog, we will continue with step two by shifting gears and answering important questions related to bonds and alternative investments. These questions are tailored to individual investors and have answers that can be proven or disproven with reference to evidence.

Question: What is the role of bonds and what types of bonds are most appropriate?

Answer: Bonds reduce risk and provide income. They always have been a “go-to” for protecting principal and generating income. However, due to many investment options in the marketplace and interest rates reaching near historic lows, the function of bonds is less straightforward than it has been in the past. As an investor, it’s important to know exactly what types of bonds you should consider.

To protect against a variety of market conditions, evidence has led us to a five-part bond allocation.

- Intermediate (1)-and short-term bonds (2) are the largest allocation and are blended with the other three components of a diversified bond portfolio.

- Multi-sector bond strategies (3) provide access to many “non-indexed” areas of the fixed income

universe such as credit-oriented sectors, adding an element of total return potential. - Inflation-protected securities (4) have low correlations with other bonds, particularly during periods of high unexpected inflation.

- International bonds (5) offer additional diversification outside U.S. interest rates.

By investing in bonds, you recognize that your investment in stocks will need to decrease, which lowers expected returns. With that said, the reduced risk of high-quality fixed income can help protect your money when the stock market is challenged.

Evidence: Determining how to allocate and diversify your bond portfolio requires a deep understanding of the correlation of various bond strategies. A simple street vendor analogy can help you understand how correlation strategies could work in the everyday world. Street vendors often sell seemingly unrelated products such as umbrellas and sunglasses. Initially, that may seem odd. After all, when would a person buy both items at the same time? They probably never would. Umbrellas and sunglasses have a very low correlation. By diversifying the product line, the vendor can reduce the risk of losing money on any given day. Rain or shine, the street vendor prospers.

By investing in bonds that do not behave similarly in the marketplace, you will reduce risk and volatility. While bonds reduce risk and provide income to your portfolio, it is not simply enough to only diversify with bonds. This leads us to our next meaningful question around investing in other assets beyond stocks and bonds.

Question: Should diversified portfolios invest in assets other than stocks and bonds?

Answer: If the alternative investments are transparent, reasonably liquid, accessible, and truly diversifying, then you should consider adding them to your investment portfolio. Alternative asset classes allow for resiliency because of their low correlation with stocks and bonds (think about the umbrella vendor), allowing for overall risk reduction and the potential for higher returns that cannot be obtained otherwise.

Savant recommends four core alternative strategies to our clients looking to invest in alternatives:

- Trend Following: Takes advantage of price trends across stocks, bonds, currencies, and commodities. Follows trends by buying assets that have been rising in price and selling assets that have been falling in price.

- Event Driven: Seeks uncorrelated returns and a liquidity risk premium created by market dislocations and corporate events such as mergers, acquisitions, or bankruptcies that create temporary pricing inefficiencies.

- Reinsurance: Natural disasters are independent of financial market activity. Investors are rewarded for bearing diversified exposure to catastrophe risk by purchasing Insurance-Linked Securities (ILS) like quota shares and catastrophe (cat) bonds.

- Real Assets: A blend of infrastructure, farmland, and timberland asset classes that benefit from contractual cash flows generated by tangible assets. Can consist of both private and public investments and can be either equity or debt.

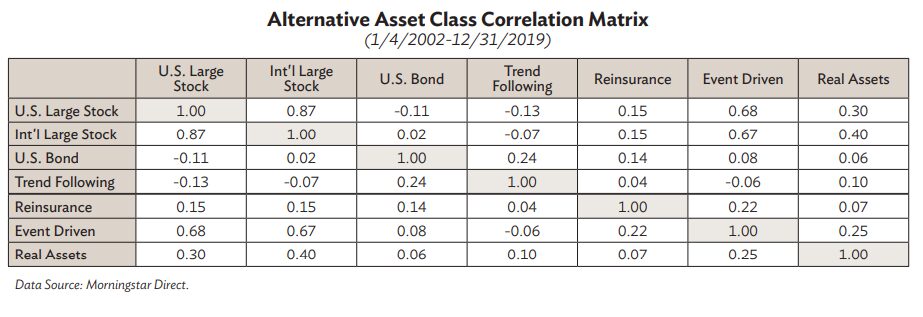

Evidence: The evidence shows that adding Trend Following, Event Driven, Reinsurance, and Real Assets to a portfolio can result in a clear diversification benefit. These alternative investments can help achieve favorable results in a variety of economic and market environments.

The figure below illustrates the low correlation these assets have not just to stocks and bonds, but also to each other.

In Summary

Enhancing your portfolio with bonds and alternative investments can be a good idea if approached strategically and through an EBI lens.

Once the evidence has been gathered, the focus turns to implementation. This includes several key areas: investment selection, rebalancing, and managing taxes.

For more information, download our EBI whitepaper or consult with your financial advisor.