A Response to Market Volatility

With investment markets in full panic mode as a result of the World Health Organization declaring the COVID-19 virus to be a global pandemic, traders on Wall Street are selling at virtually any price, which has caused the markets to drop into bear market territory.

The long bull run that started in March 2009 and set many records along the way is now officially over. May we all remember it fondly.

It is almost impossible to keep a rational perspective in the middle of a herd that is stampeding toward the exits, and this particular stampede can fairly be described as one of the worst in market history. This is the fastest bear market ever; that is, the fastest that the U.S. stock market has experienced a decline of 20% or more going back to 1915. The average number of days from peak to a 20% decline is 255, and the median is 156. The recent market selloff reached this dubious achievement in just 17 trading sessions.

The COVID-19 pandemic (as it is now known) should first be considered a health issue, and everybody should do what they can to protect themselves and their families from the spread of the virus. It goes without saying that your health is more important than your portfolio.

Is your health at risk? The World Health Organization has suggested (see graphic below) that the COVID-19 virus in China was more deadly, on a percentage basis, than the Spanish flu epidemic that raged across the world in 1918-1920. So far, it has been more deadly than cholera, much more than swine flu or hepatitis A. On the other hand, reports indicate that the elderly and people with pre-existing health issues are far more likely to die of the flu than younger and healthier people, and the death rate outside of China has been roughly half of the Chinese experience. More testing will be needed before we know the full extent of the infected population and the morbid statistics for those who are infected.

But once health precautions are taken, it is appropriate to address the potential for losses and how best to navigate the market conditions. There are news reports that the U.S. government will propose a payroll tax cut, and possibly offer short-term lending solutions to key publicly-traded companies in the travel and entertainment industry. There is also the likely scenario that there will be some meaningful, globally synchronized fiscal stimulus. While the Federal Reserve has already cut a key interest rate by half a percent and announced it would inject more than $1.5 trillion of temporary liquidity into Wall Street today and tomorrow, it has not had much impact on market sentiment.

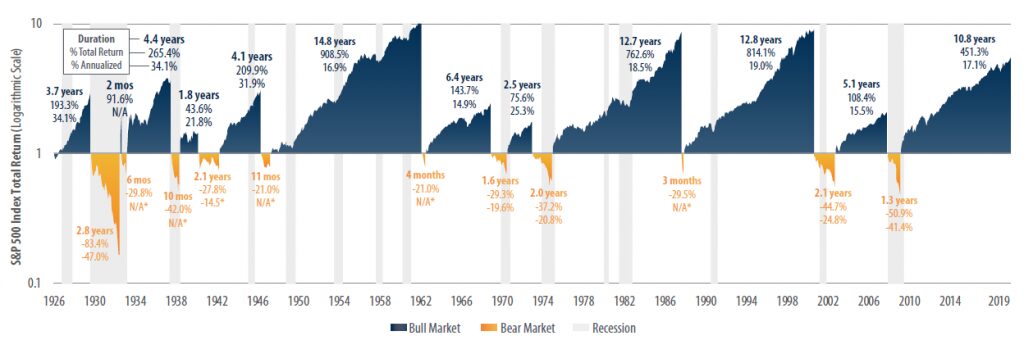

Historically, bear markets have been less impactful than their bull market counterparts, as you can see from the accompanying chart below. The average bull market lasted 6.6 years, while the average bear market lasted 1.3 years. Of course, you could argue that a global pandemic is different from a housing market crash. Research analysts at Goldman Sachs took a look back at “event-driven” bear markets; that is, market declines that were not driven by an economic recession, but instead were triggered by events like war, oil price shocks or an emerging-market crisis. They found that the average event-driven bear market resulted in a 29% decline—on average. The report notes that we have never before entered a bear market due to a viral outbreak, but in the past, bear markets triggered by “exogenous shocks” have recovered their previous levels within 15 months.

There is some good news for many investment portfolios: bonds have gained in value, as bond yields have fallen to record lows (Bloomberg Barclays U.S. Aggregate Bond Index, up 3.8% year-to-date as of 3-11-20). Furthermore, assets that are uncorrelated to stocks such as managed futures (Credit Suisse Managed Futures Liquid Index, up 2.4%) and reinsurance (SwissRe Global Cat Bond Index, up 1.8%) are also up year-do-date. This performance, so directly counter to stock movements, explains why it is so necessary to hold diverse investments in a portfolio.

The harder conversation is about market timing. Most people understand that it is impossible to time the market without a working crystal ball. But this is easily forgotten when the daily headlines announce that your net worth is falling by 4-7% in a single day, when the stock portion of your portfolio has fallen by 20% in record time. The natural question is: should I get out now and avoid more of the same?

There is only one rational answer to this question: it has never been a good idea to sell when everybody else is selling, just as it has never been a winning strategy to buy stocks when everybody else is wildly bullish. The best strategy has, in the past, been to ride out the downturn and experience the subsequent upturn—which may come tomorrow, next week, next month or next year.

Make no mistake: bear markets like the one we have just entered pose a real danger to your future financial health. There is a real danger in selling at the bottom and then missing out on the recovery.

Sources: Morningstar Direct (Note: Managed futures year-to-date return is as of 3-10-20 and reinsurance year-to-date return is as of 3-6-20, both the most recent available index data), Bob Veres, The Irrelevant Investor (“The Fastest Bear Market Ever”, 3-9-20), Bull/Bear Market exhibit: FirstTrust Advisors, Bloomberg. Based on monthly returns–returns using different periods would produce different results. The S&P 500 Index is an unmanaged index of 500 stocks used to measure large-cap U.S. stock market performance. Investors cannot invest directly in an index. Index returns do not reflect any fees, expenses, or sales charges. This chart is for illustrative purposes only and not indicative of any actual investment. These returns were the result of certain market factors and events which may not be repeated in the future. Past performance is no guarantee of future results. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person.